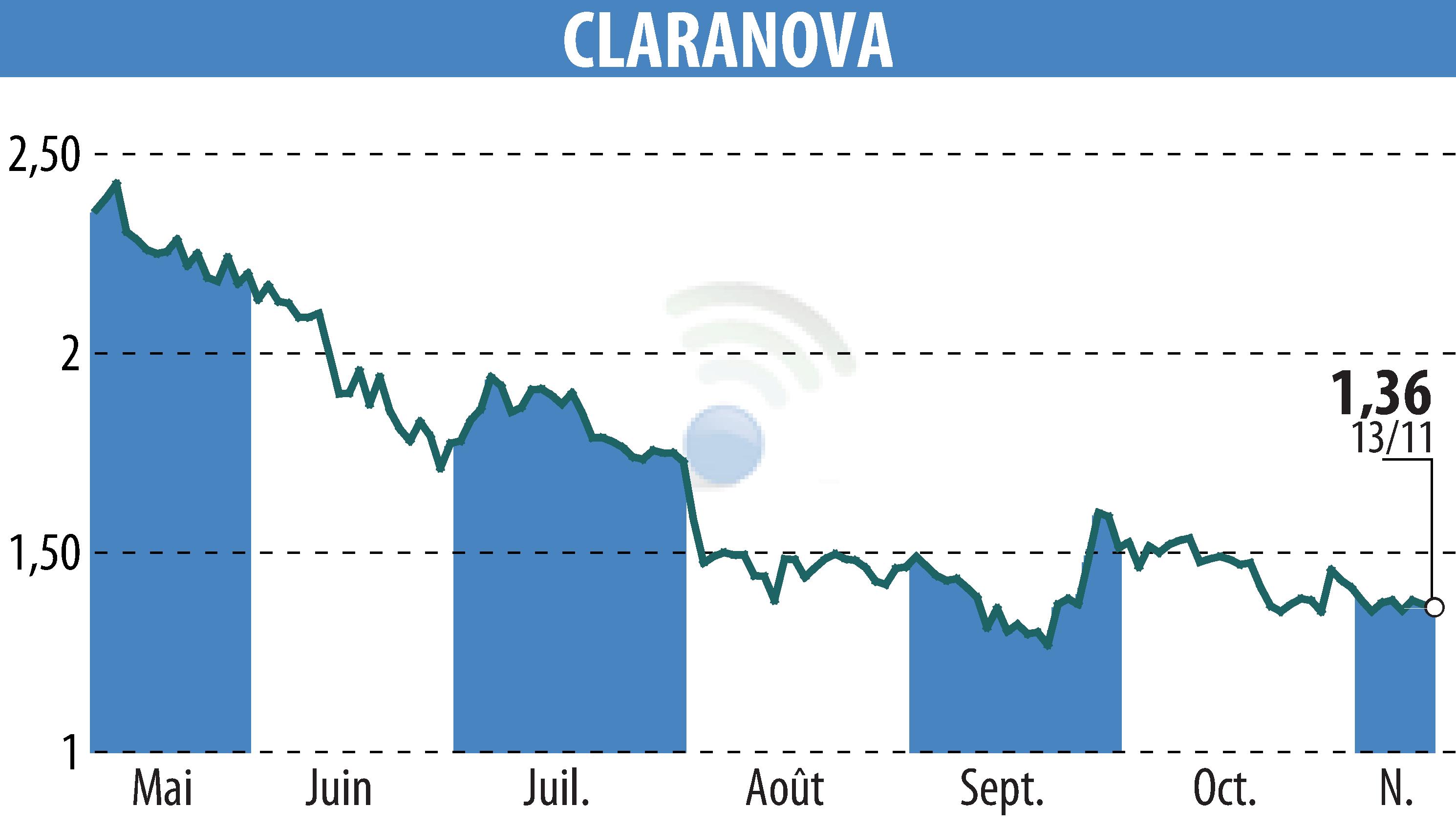

on Claranova (EPA:CLA)

Claranova Reports Stable Revenue Amid Strategic Shifts

Claranova announced its Q1 2024-2025 revenue of €89 million, a slight 2% decrease from last year. This dip is attributed to the sale of non-core Avanquest activities, worth nearly €2 million in Q1 2023-2024. The company's new "One Claranova" roadmap aims for future growth, though its impact isn't reflected in this quarter's figures yet.

The acquisition of PlanetArt's minority interests supports Claranova's transition into an integrated company, aligning with its core business focus. This move aligns with the group's strategy to enhance profitability and implement operational synergies. Despite the slight revenue decline, Claranova maintains its target for a 5%-8% compound annual growth rate and aims for €575-625 million in annual revenue by 2027.

PlanetArt remained stable with €60 million revenue, while Avanquest showed a 3% like-for-like growth, bolstered by the sale of non-core European activities. In contrast, myDevices experienced a 12% revenue drop, leading Claranova to retain a bank to sell this division.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Claranova news