on Deutsche Wohnen AG (isin : DE000A0HN5C6)

Deutsche Wohnen Reports Stable Performance for Early 2024

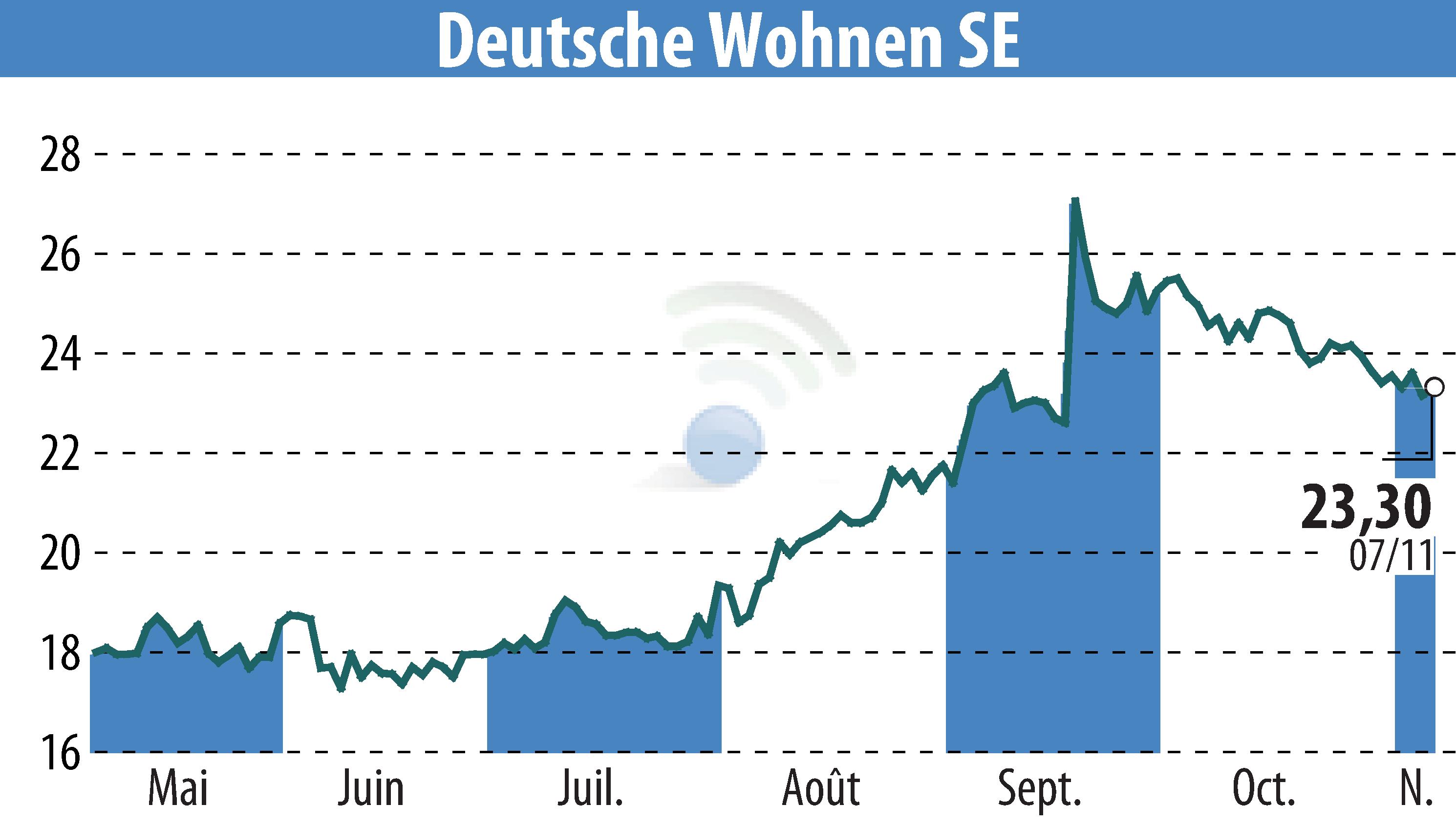

Deutsche Wohnen SE announced stable results for the first nine months of 2024 amidst a challenging real estate market. The company reported an Adjusted EBT of €384.1 million, equating to €0.97 per share, which marks a decrease from the previous year. The Net Asset Value (NAV) per share also dipped by 2.2% to €41.84.

The firm's vacancy rate maintained a low level at 1.6%, while the in-place rent per square meter rose by 3.3% to €7.91. Despite a slight drop in Adjusted EBITDA Rental, at €473.6 million (down by 1.4%), Deutsche Wohnen showed operational stability. The Operating Free Cash-Flow increased significantly by 59.4% to €386.6 million.

Deutsche Wohnen's focus remains on managing residential properties within dynamic German metropolitan areas, with a portfolio of approximately 140,000 units.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Deutsche Wohnen AG news