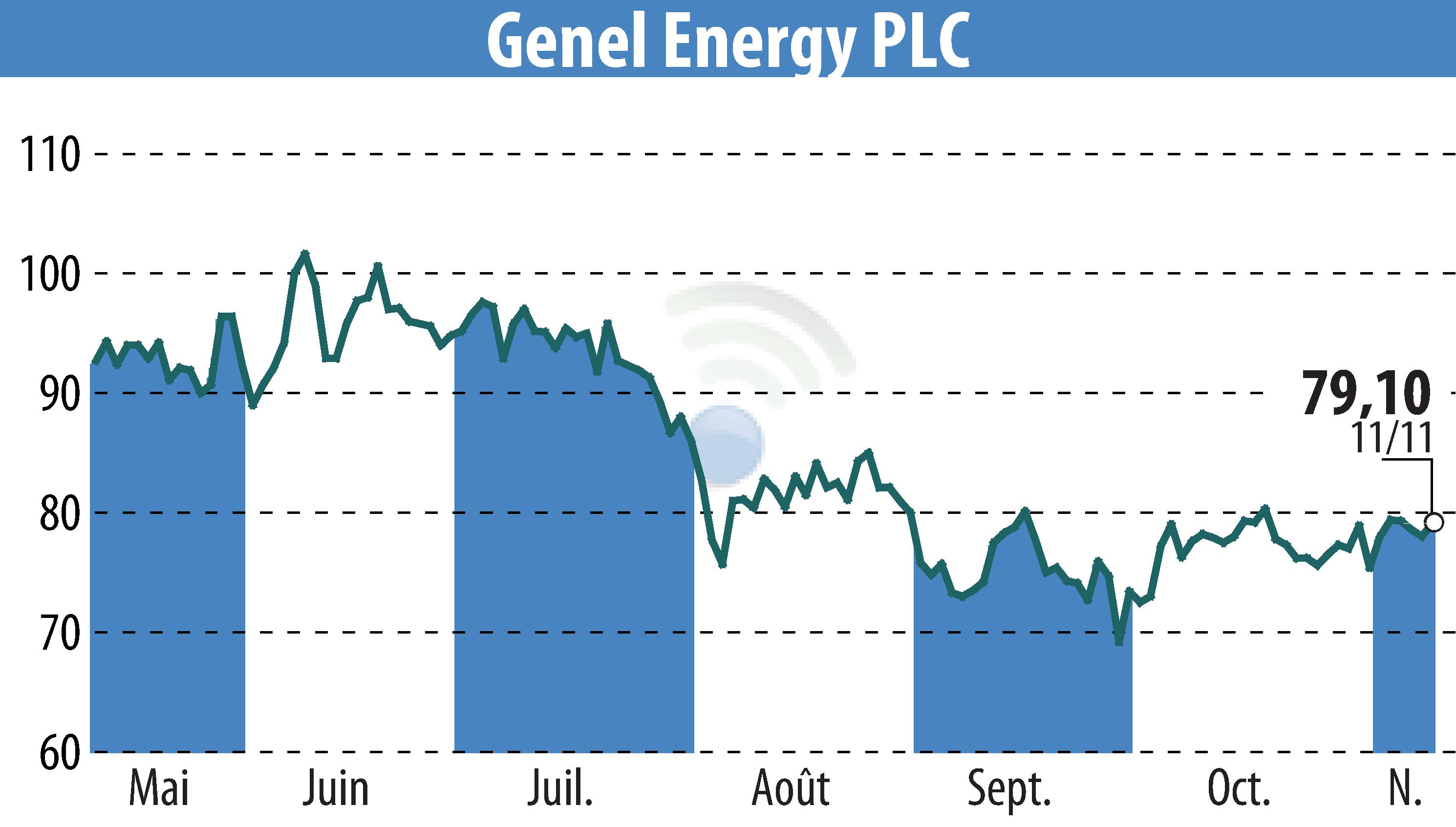

on Genel Energy (isin : JE00B55Q3P39)

Genel Energy PLC: Financial and Operational Stability in Q3 2024

Genel Energy PLC reports strong financial positioning for Q3 2024. The company reduced its debt significantly from $248 million to $66 million by repurchasing and cancelling $182 million in bonds. As of October, Genel's net cash stood at $125 million with total cash reserves of $191 million.

Tawke PSC's steady production continues to meet domestic demand, generating cash flows that exceed expenditures. Year-to-date free cash flow is reported at $20 million, showing resilience in cash generation compared to the previous year's outflow.

Operational highlights include bringing three previously drilled wells onto production and ongoing well interventions. The anticipated arbitration award on the Miran and Bina Bawi assets is still pending, expected by year-end.

Genel's ongoing ESG initiatives include emissions reduction projects and community healthcare efforts in Somaliland. The company anticipates maintaining a strong financial position and sees potential in new asset acquisitions and export resumption.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Genel Energy news