on Gimv (EBR:GIMB)

Gimv Reports Solid First Quarter Performance in 2024-25

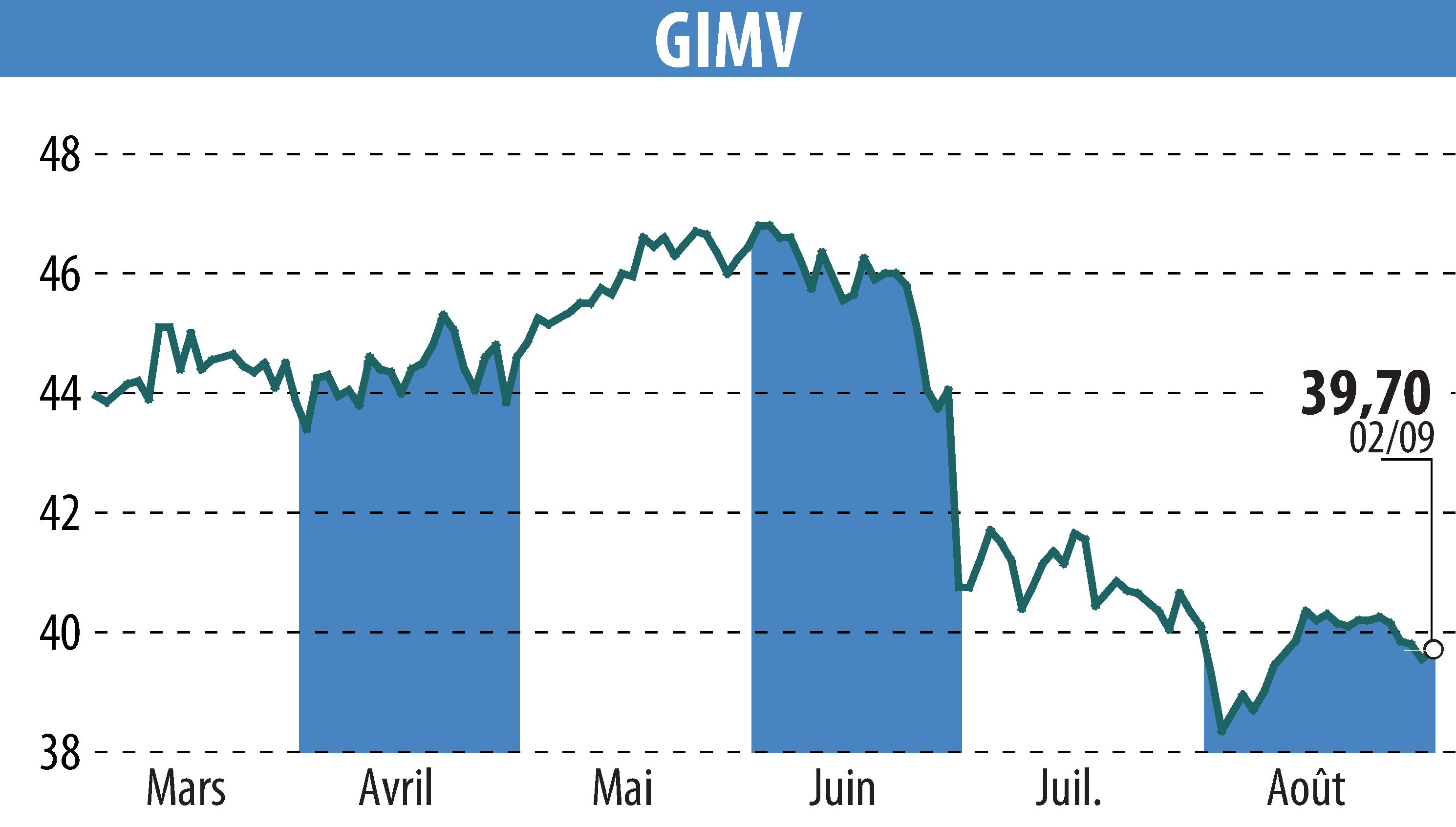

Antwerp-based investment company Gimv has announced a positive platform portfolio return of 3.5% for the first quarter of the financial year 2024-25, meeting its long-term return targets. This has contributed to an increase in the Net Asset Value (NAV) per share to EUR 52 as of the end of June 2024.

During early 2024, Gimv's portfolio companies maintained revenue growth and expanded margins. The firm's EBITDA growth acts as a key driver for future NAV growth. Recent investments include acquisitions in SMG (Germany) and Curana (Belgium).

Gimv completed the acquisition of Belfius Insurance's 10.6% stake in TINC, raising its total stake to 21.3%. The company also signed an agreement for the sale of a portfolio interest, positively impacting NAV by EUR 0.5 per share.

Further deal activity is anticipated in the year's second half, bolstered by accumulated cash reserves of approximately EUR 300 million and strategic bolt-on acquisitions.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Gimv news