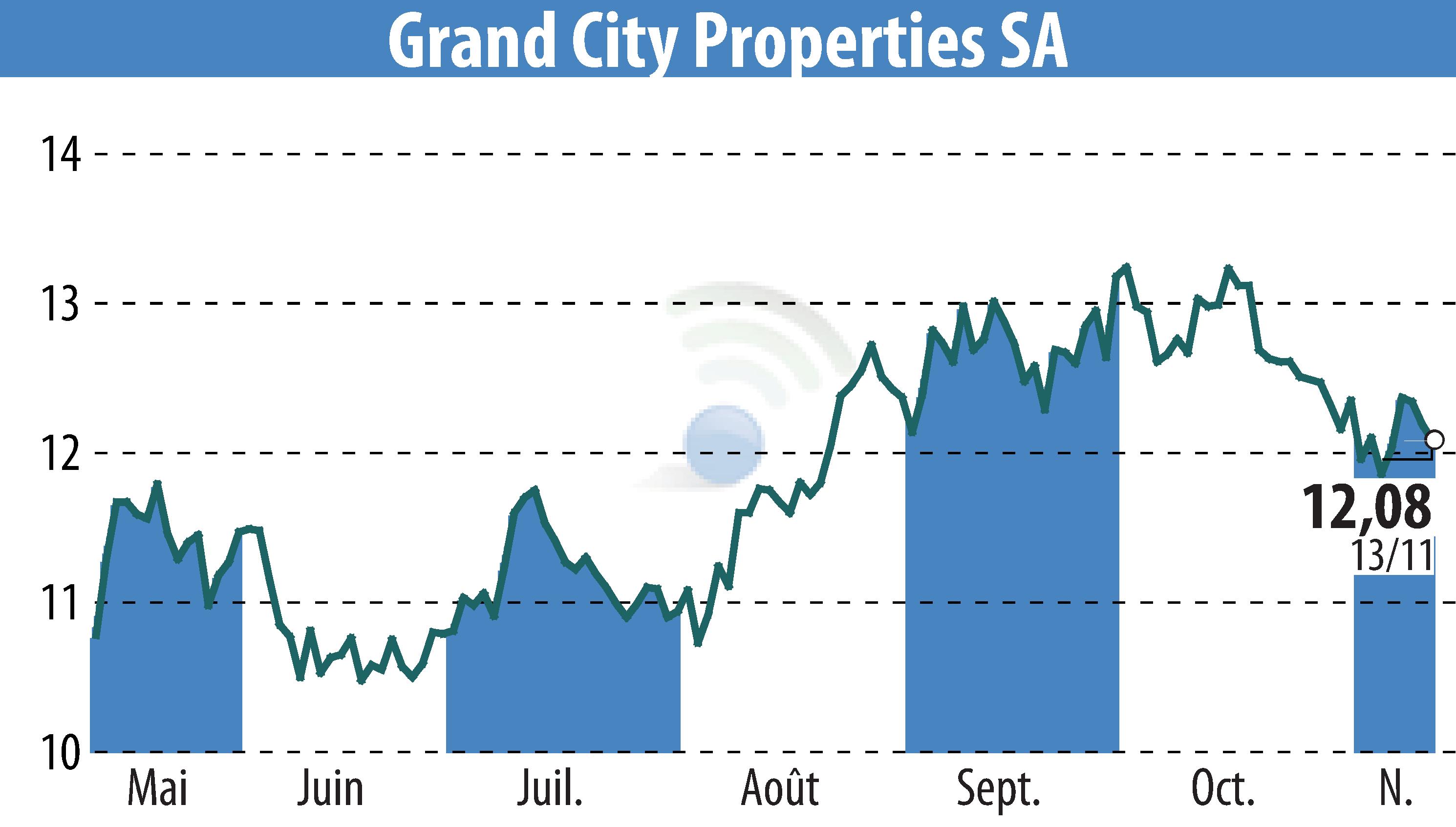

on Grand City Properties S.A., (isin : LU0775917882)

Grand City Properties Reports Steady Growth in 9M 2024

Grand City Properties S.A. reported a 3% increase in net rental income, reaching €317 million for 9M 2024, compared to €307 million in the same period of 2023. This growth was driven by a 3.5% like-for-like rental increase.

The company achieved an adjusted EBITDA of €250 million, marking a 5% improvement from €240 million in 9M 2023. FFO I remained stable at €141 million, as operational growth offset higher financing costs. Despite a €17 million loss from property revaluations, Grand City maintains strong liquidity with €1.5 billion in cash and assets.

With a stable LTV ratio of 36% and €6.2 billion in unencumbered assets, the company maintains a conservative financial stance. The EPRA NTA stood at €4 billion, consistent with the end of 2023. Grand City confirms FY 2024 guidance, expecting FFO I between €180 and €190 million.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Grand City Properties S.A., news