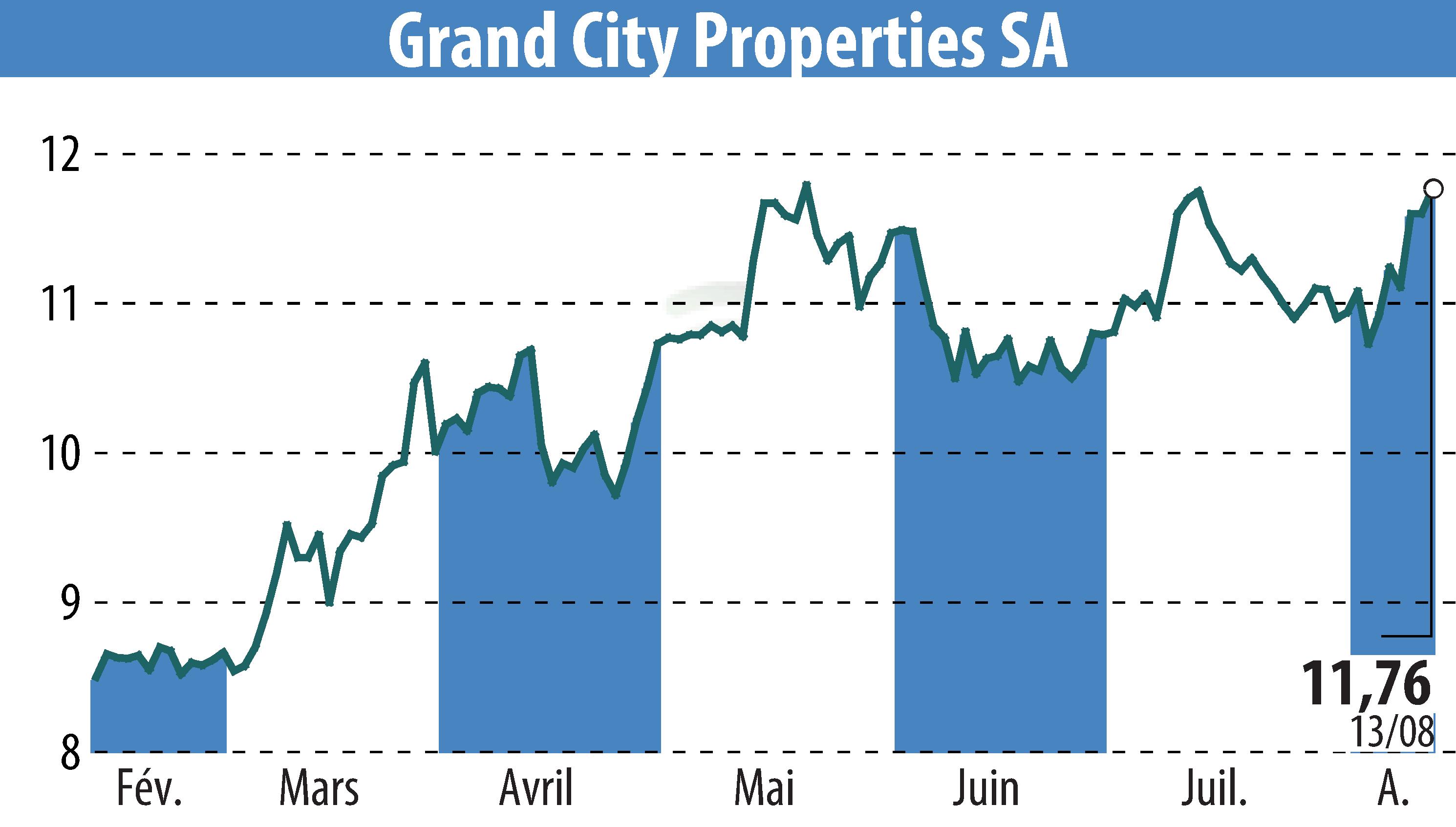

on Grand City Properties S.A., (isin : LU0775917882)

Grand City Properties S.A. Announces H1 2024 Results with Increased Guidance

Grand City Properties S.A. has reported a net rental income of €212 million for H1 2024, marking a 3% increase from €204 million in H1 2023. This growth is attributed to a like-for-like rental increase of 3.4% driven by in-place rent growth. Additionally, the company experienced an adjusted EBITDA of €166 million, up 4% year-over-year.

The firm's Funds From Operations (FFO I) remained stable at €94 million and €0.54 per share, consistent with H1 2023. Despite the negative property revaluations recognized during the period resulting in a net loss of €74 million and a basic loss per share of €0.38, operational growth and stable finance expenses helped offset some impacts.

Grand City Properties carried out a full portfolio revaluation in H1 2024, noting a like-for-like value decline of 2% and achieving a portfolio net rental yield of 5.0%. The company maintains a conservative financial position with a liquidity of €1.1 billion, an LTV of 37%, and an ICR ratio of 6.0x as of June 2024.

The company successfully executed capital markets transactions in Q2 and Q3 2024 and increased its FY 2024 FFO I guidance to €180-€190 million. These movements, accompanied by strategic debt management, enhanced Grand City's financial stability and outlook for future growth.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Grand City Properties S.A., news