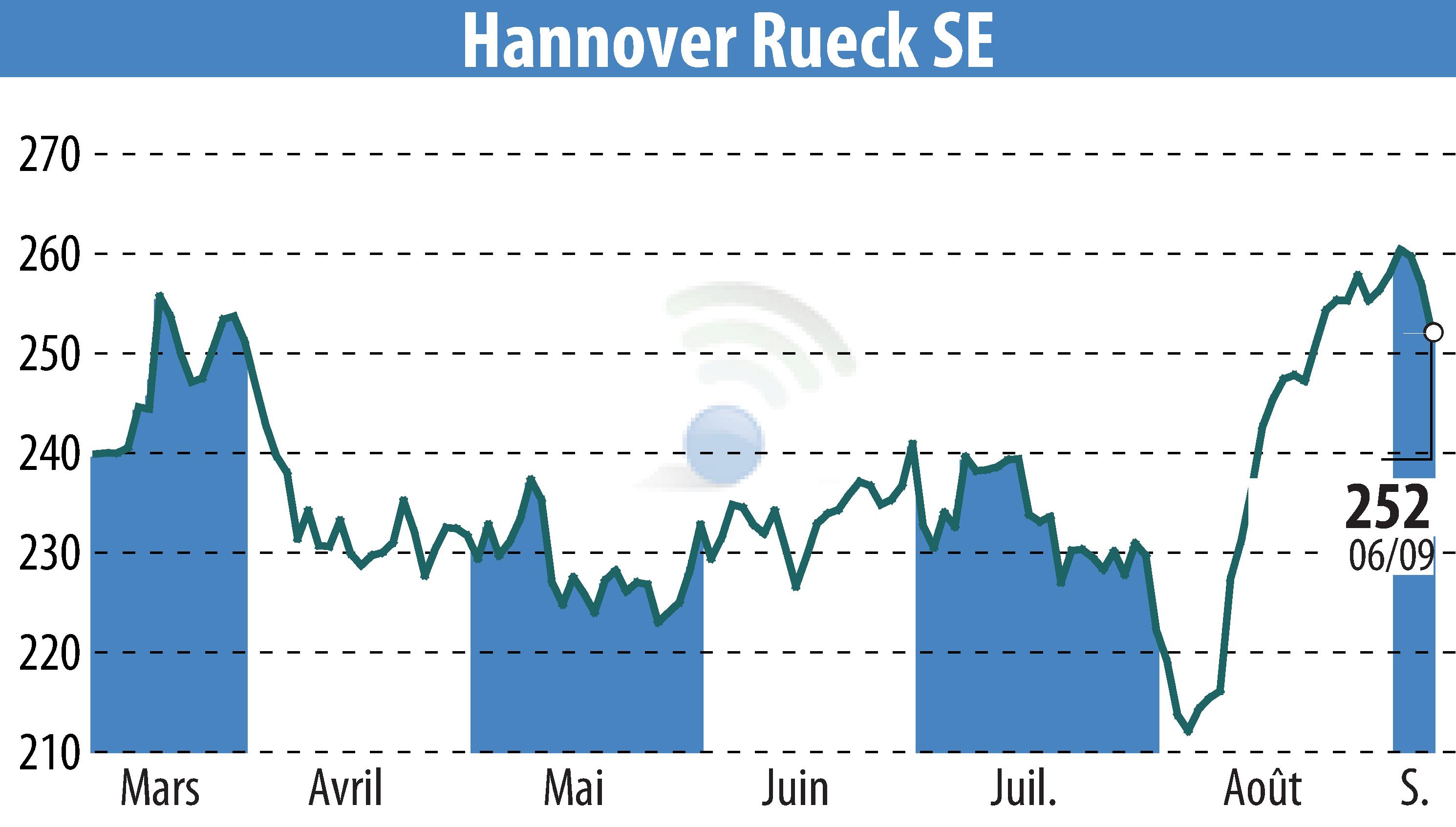

on Hannover Rück SE (isin : DE0008402215)

Hannover Re Sees Continued Strong Demand for High-Quality Reinsurance Protection

Hannover Re reports a sustained strong demand for high-quality reinsurance protection and foresees stable prices and conditions for the treaty renewals in property and casualty reinsurance by 1 January 2025. Throughout 2024, prices and conditions improved in some areas and stabilized in others. This favourable market state allowed Hannover Re to expand its portfolio with existing clients and initiate new business ventures.

Jean-Jacques Henchoz, CEO of Hannover Re, emphasized the importance of adequate rate levels to offer reliable coverage amidst rising insured losses. With a capital adequacy ratio under Solvency II of 276% as of June, Hannover Re’s capitalisation remains robust.

Hannover Re continues to adapt by identifying emerging risks and developing coverage solutions, such as the world's first catastrophe bond for cloud outages. Rising cyber risks and climate change were identified as ongoing challenges, with innovative solutions like parametric covers helping to mitigate climate-related risks.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Hannover Rück SE news