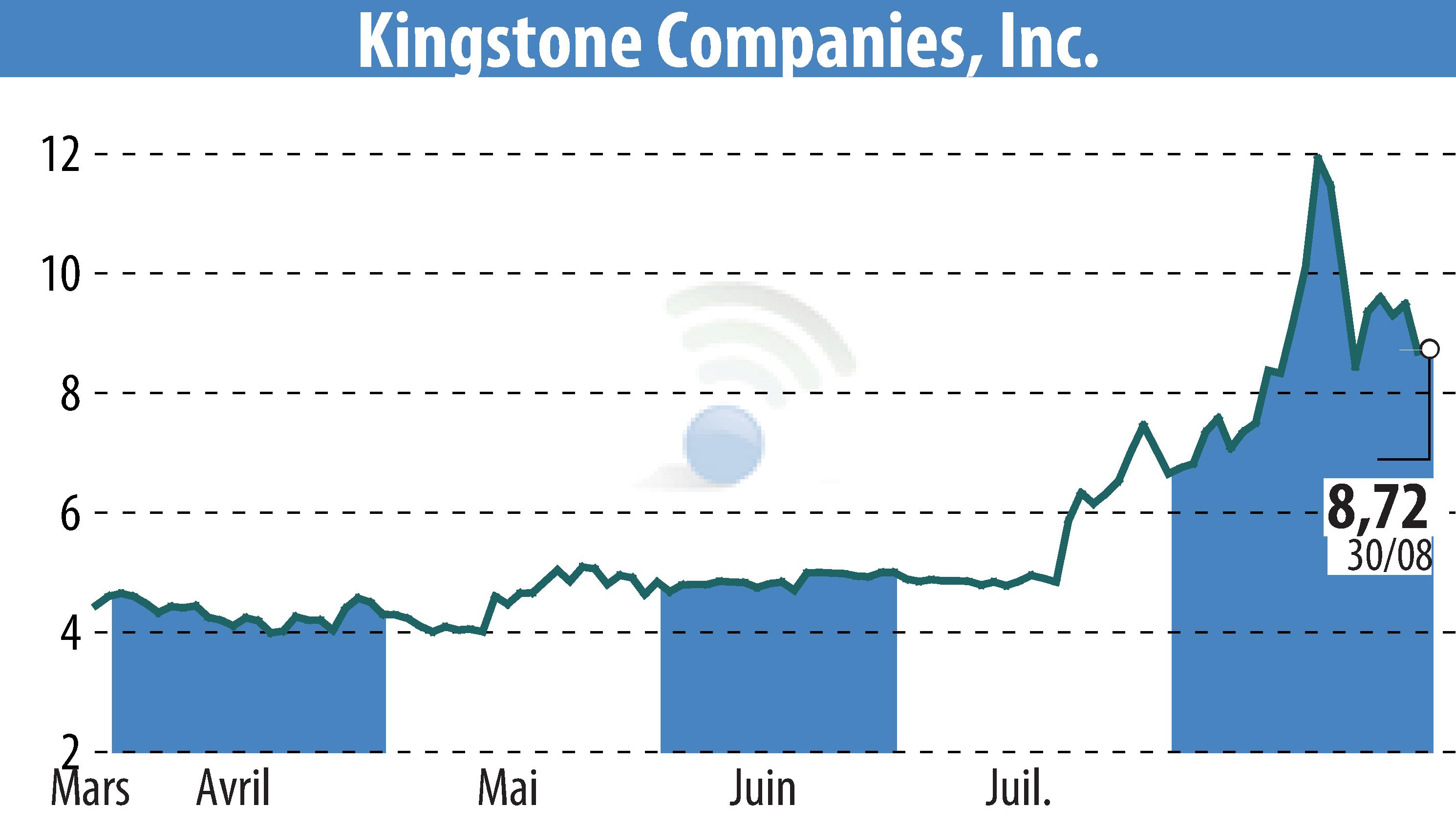

on Kingstone Companies, Inc (NASDAQ:KINS)

Kingstone Reduces Debt By 25% and Extends Maturity to June 2026

Kingstone Companies, Inc. (NASDAQ:KINS), a regional property and casualty insurance holding company, announced a refinancing of its outstanding 12% Senior Notes, which were due on December 30, 2024. The new Note Exchange Agreement will replace the $19.95 million existing notes with new 13.75% Senior Notes totaling $14.95 million, along with $5 million in cash.

This restructuring, which will close on September 12, 2024, extends the maturity to June 30, 2026. It also extends the expiration date for the warrants issued in 2022. Kingstone's CEO, Meryl Golden, emphasized that the refinancing provides the company with financial flexibility and aims to enhance stockholder value by reducing debt and interest expenses.

Kingstone operates primarily in the Northeast, offering personal lines and commercial auto insurance through its subsidiary, Kingstone Insurance Company. The firm continues to focus on profitable growth opportunities.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Kingstone Companies, Inc news