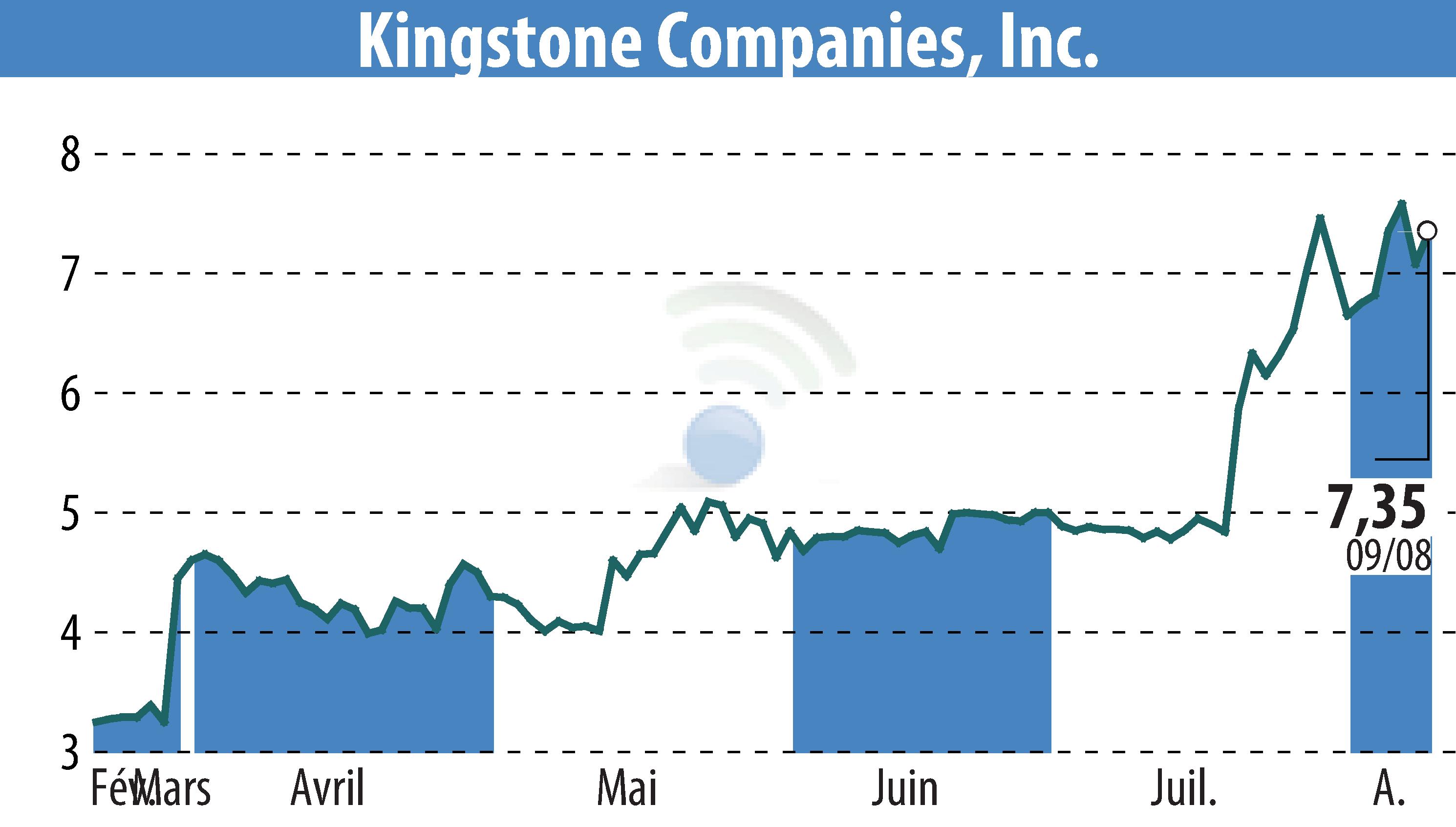

on Kingstone Companies, Inc (NASDAQ:KINS)

Kingstone Reports Double-Digit Premium Growth and Third Consecutive Quarter of Net Income

Kingstone Companies, Inc. (Nasdaq: KINS), a property and casualty insurance holding company, announced double-digit premium growth in its core business for Q2 2024. Direct premiums written increased by 21.5% compared to Q2 2023, reaching $51.3 million. For the first half of 2024, the increase was 17%, totaling $97.9 million. The net combined ratio improved to 78.2%, from 98.9% a year earlier.

Net income for Q2 2024 reached $4.5 million, a significant turnaround from a loss of $522,000 in Q2 2023. Basic earnings per share were $0.41, compared to a loss of $0.05 per share in the previous year. The return on equity soared to 47.2%, from a negative 6.4%.

Kingstone's CEO, Meryl Golden, attributed the performance to favorable weather, a reduction in non-core business, and improved expense management. The company raised its full-year 2024 guidance, expecting core business direct premiums written to grow between 25% and 35%, with a combined ratio between 84% and 88%. For 2025, growth is expected in the range of 15% to 25%.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Kingstone Companies, Inc news