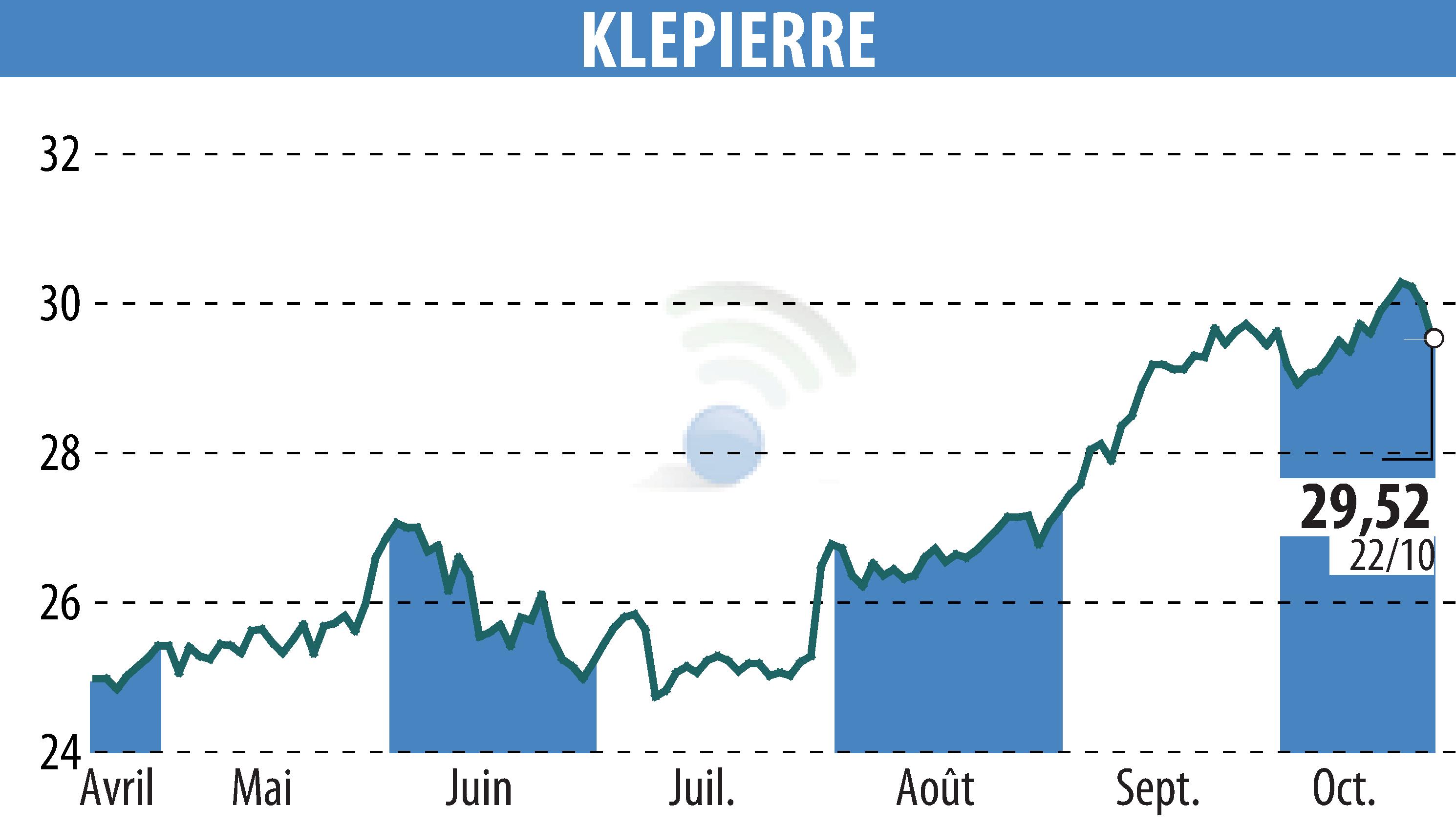

on KLEPIERRE (EPA:LI)

Klépierre Revises Upwards 2024 Financial Guidance

On October 23, 2024, Klépierre, a leader in the European retail real estate sector, announced an upward revision of its 2024 financial guidance. This decision comes after the company reported a 6.3% increase in like-for-like net rental income over the first nine months. Such growth was fueled by strong leasing demand, leading to 1,280 signed leases and a 4% positive rental uplift.

The financial occupancy rate rose to 96.5%, contributing to retailer sales growth of 4.0% like-for-like, supported by a footfall increase of 2.4%. Sector-leading credit metrics are maintained, with a net debt to EBITDA ratio of 7.2x and a cost of debt at 1.7%.

Notably, Klépierre has been recognized by GRESB as the top company globally in the listed retail category for sustainability performance. As a result of these performances, Klépierre anticipates a 6% rise in EBITDA and net current cash flow, reaching €2.55 per share in 2024.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all KLEPIERRE news