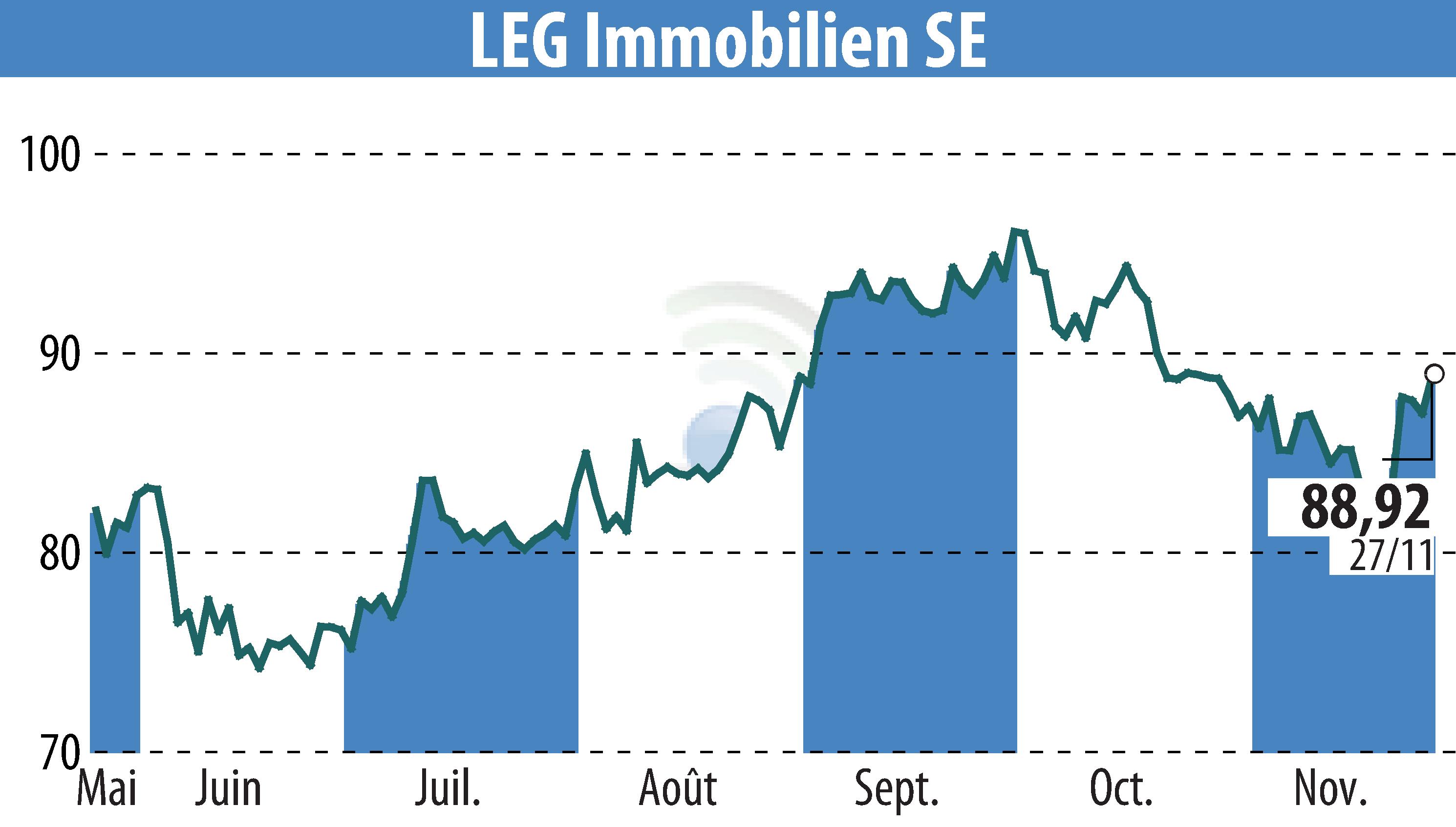

on LEG Immobilien AG (isin : DE000LEG1110)

LEG Immobilien Upsizes Convertible Bonds with EUR 200 Million Tap Issue

LEG Immobilien SE has successfully expanded its convertible bonds through a EUR 200 million tap issue. This follows the company's previous EUR 500 million bond issued in September 2024. The new bonds, guaranteed by LEG and issued by its Dutch subsidiary LEG Properties B.V., allow conversion into 1.75 million shares, representing 2.3% of LEG's share capital. This placement caters exclusively to institutional investors outside the United States.

These new bonds are set to become part of the existing series alongside the September issue, with a slightly higher issue price of 103.80664% of par. Settlement is anticipated around December 5, 2024. LEG aims to incorporate these bonds into the Frankfurt Stock Exchange's Open Market trading segment.

The company plans to use net proceeds to refinance existing debt and for general corporate purposes, despite excluding pre-emptive rights for shareholders. A 90-day lock-up period applies post-issue, with certain exceptions agreed upon with the Joint Global Coordinators.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all LEG Immobilien AG news