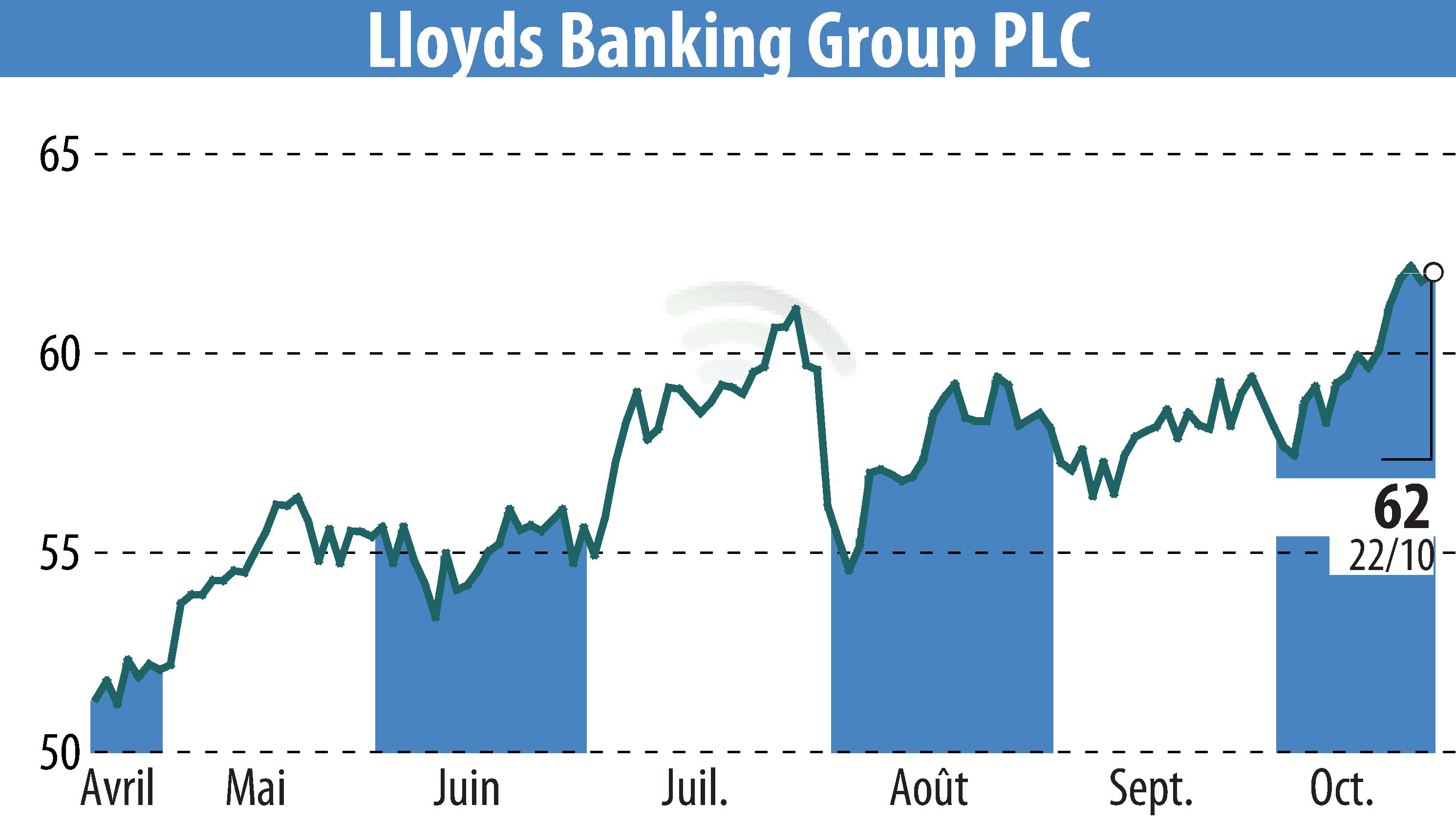

on Lloyds Banking Group (isin : GB0008706128)

Lloyds Banking Group Reports Robust Q3 2024 Financial Performance

Lloyds Banking Group PLC announced a strong financial performance for the third quarter of 2024. Statutory profit after tax reached £3.8 billion, despite a 7% decline in net income due to increased operating costs, including the Bank of England Levy. Underlying net interest income was £9.6 billion, a decrease of 8% compared to the previous year. However, the third quarter saw a 2% rise in this metric, attributed to a banking net interest margin of 2.95%.

The Group also reported a 9% increase in underlying other income, driven by strengthened customer and market activities. Operating expenses climbed by 5% to £7.0 billion due to higher strategic investments and inflationary pressures. Underlying impairment charges were significantly reduced, reflecting resilient asset quality.

CEO Charlie Nunn expressed confidence in achieving 2024 targets, supported by capital generation of 132 basis points year-to-date and a CET1 ratio of 14.3%.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Lloyds Banking Group news