on MLP AG (isin : DE0006569908)

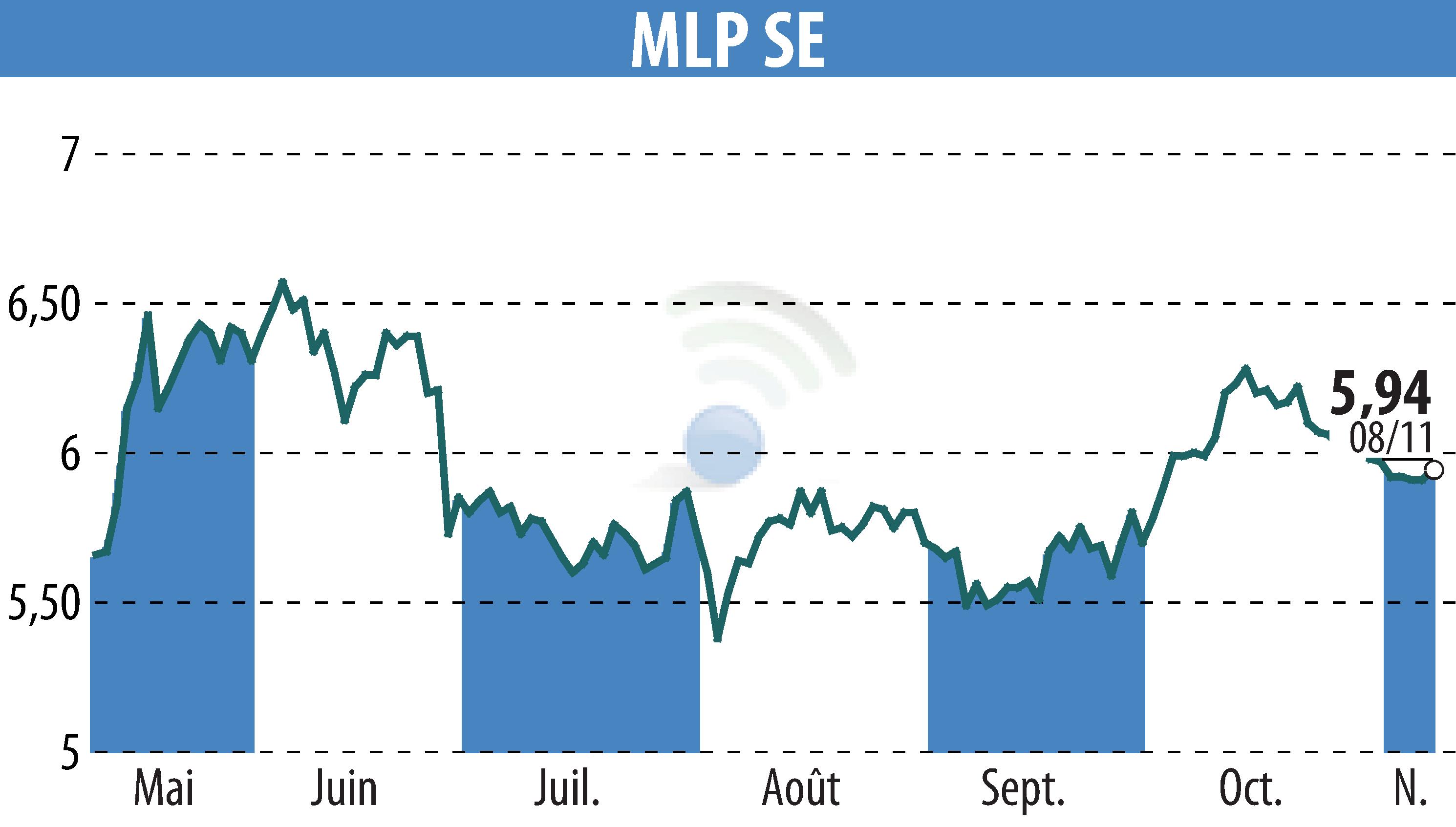

MLP SE Anticipates Strong Q3 Performance, Reaffirms 'Buy' Rating

Financial services group MLP SE is set to release its Q3 results on November 14, 2024. The company forecasts a significant year-on-year EBIT increase, driven by a €17 million boost from performance fees. Consequently, MLP has raised its full-year EBIT guidance. Sales for Q3 are expected to reach €242 million, a 15% rise from the previous year, attributable to both the performance fees and robust segment growth.

The FERI segment is projected to grow 41% to €75 million, while the Banking and Finanzberatung segments anticipate increases of 14% (€54 million) and 7% (€95 million) respectively. Despite recent interest rate declines, MLP expects a steady net interest income, positively impacting EBIT.

Q3 EBIT is projected to surge 133% year-on-year to €18 million, with an adjusted EBIT of €7 million when excluding performance fees. MLP could potentially exceed its fiscal guidance, benefiting from a favorable capital market environment and a recovering real estate segment. The 'Buy' recommendation remains, with a price target of €12 based on the 2024 forecasts.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MLP AG news