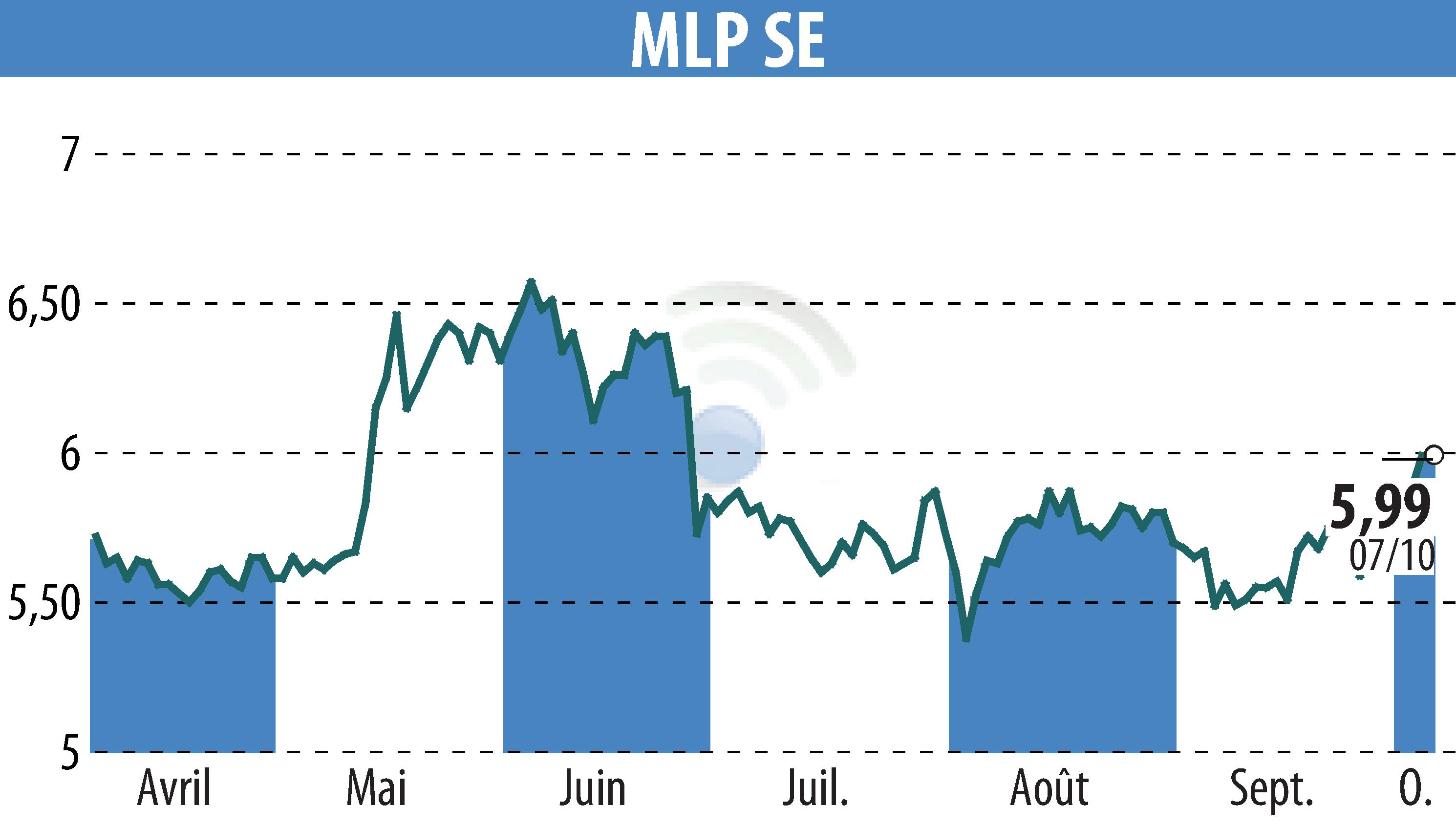

on MLP AG (isin : DE0006569908)

MLP SE Updates EBIT Guidance Amid Strong Performance Fees

MLP SE has raised its fiscal year 2024 EBIT guidance following a significant boost in performance fees from FERI's institutional fund solutions. The company reports €17 million in performance fees for the third quarter, a stark increase compared to last year's Q3 and earlier quarters of 2024.

This financial boost has led MLP to revise its fiscal EBIT guidance by €10 million, now falling between €85-95 million, aligning with previous analyst estimates. This adjustment reflects an expected EBIT expansion of 34% year over year.

The increase is primarily attributed to FERI's non-public institutional fund solutions, as public funds didn't see comparable growth. MLP's real estate business and banking sector are also projected to support future profitability, reinforcing a positive outlook on the stock.

NuWays AG maintains a "Buy" recommendation, adjusting the target price to €12.00.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MLP AG news