on MLP AG (isin : DE0006569908)

NuWays AG Reiterates 'BUY' Recommendation for MLP SE Following Robust Q2 Results

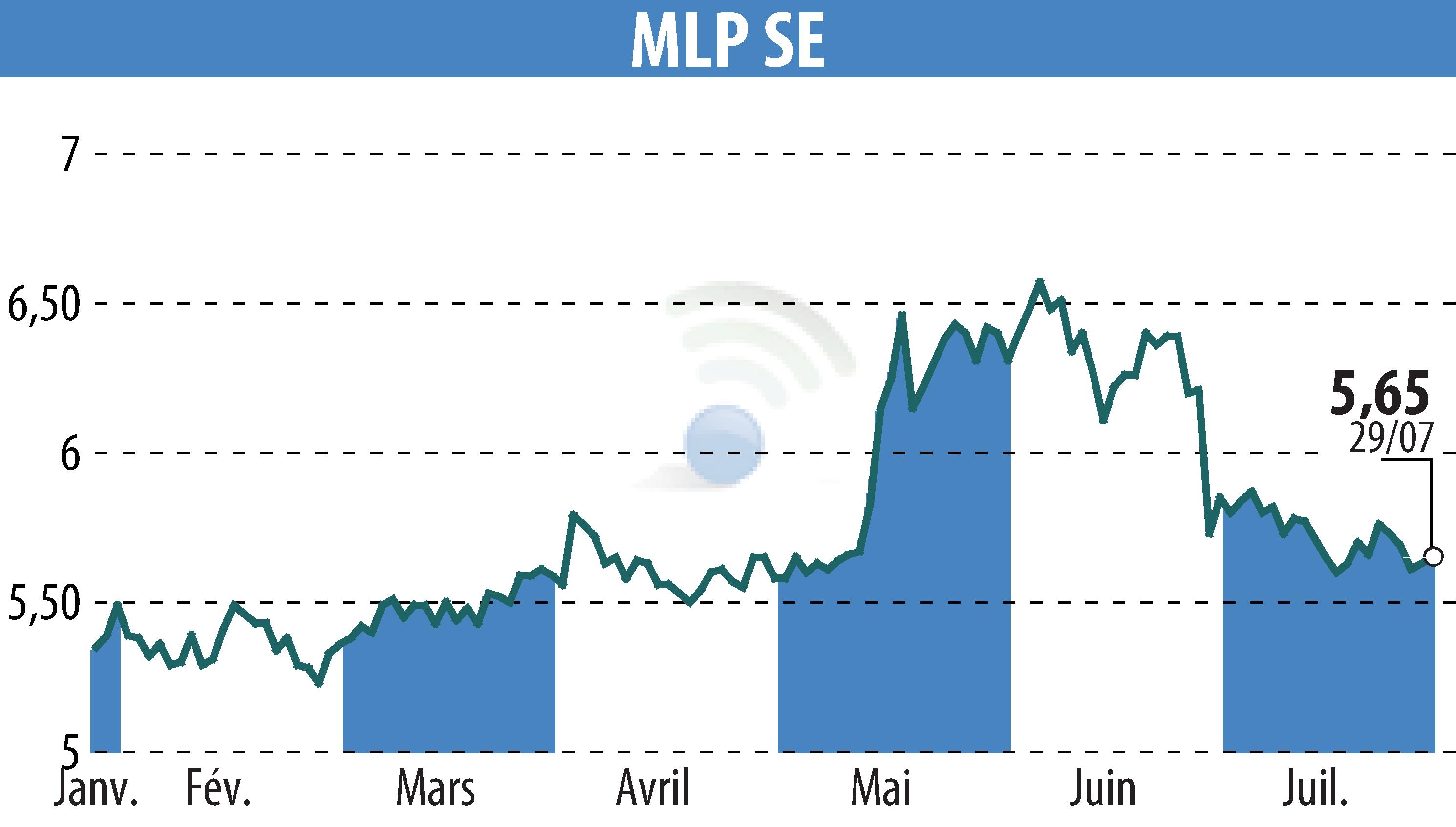

On July 30, 2024, NuWays AG updated its research on MLP SE, maintaining a 'BUY' recommendation. The target price is set at EUR 11.50. Analyst Henry Wendisch bases this on the company's strong Q2 earnings, which significantly outperformed the prior year.

MLP SE reported a preliminary Q2 EBIT of €12 million, representing a 135% year-over-year increase. Performance fees and interest rate tailwinds were the primary drivers. Additionally, €2.8 million in negative one-off effects last year provided an easier comparison base.

Performance fees, particularly from FERI's funds, reached €4.2 million due to meeting high-water marks and hurdle rates. Assets under Management (AuMs) also hit new records at €60.5 billion, a favorable sign for recurring revenue and profitability in wealth management.

Banking remained strong, with net interest income at €12.1 million, a 3% YoY increase. Given the ECB's recent interest rate changes, net interest income for FY 2024 is projected to reach €48 million.

MLP SE specified its full-year EBIT guidance towards €80-85 million but remains conservative. NuWays AG expects the actuals to surpass this due to favorable conditions in real estate and higher-than-expected AuMs.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MLP AG news