on SAPARDIS S.A. (ETR:PUM)

PUMA's Q1 2025 Sees Stagnant Sales and Strategic Cost Cuts

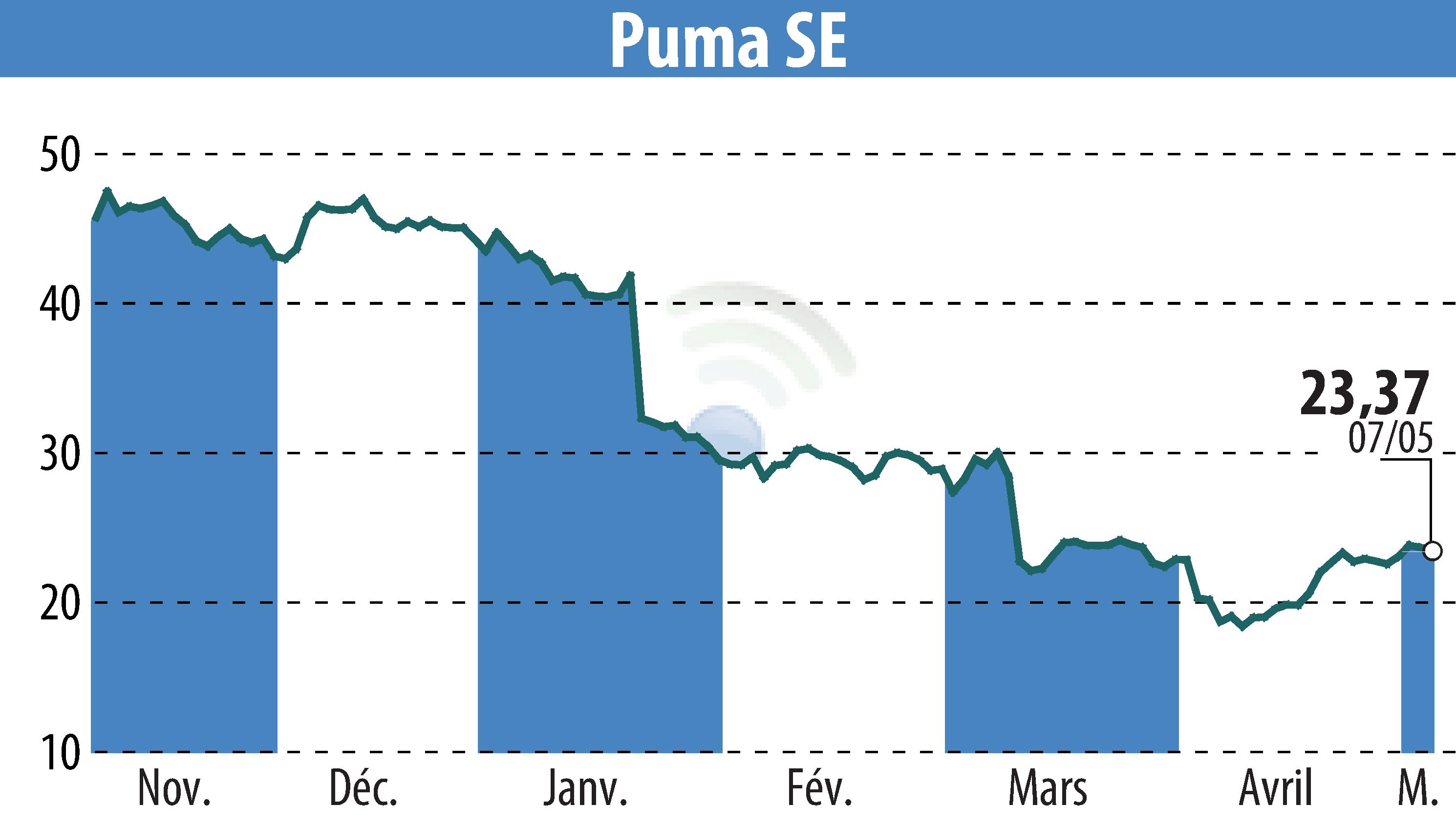

In the first quarter of 2025, PUMA reported currency-adjusted sales growth of 0.1% to €2,076 million, despite challenges in the U.S. and China markets. Gross profit margins fell by 60 basis points to 47.0%, while operating expenses rose by 7.1%, reflecting ongoing investments in their Direct-to-Consumer (DTC) segments like e-commerce. Notably, their DTC business surged by 12%, driven primarily by a 17.3% increase in online sales.

PUMA's adjusted EBIT declined by 52.4% to €76 million, impacted by higher costs and a decreased gross margin. The firm continues its "nextlevel" cost efficiency programme, including a planned reduction of 500 staff by Q2, which incurred €18 million in one-time costs this quarter.

Looking ahead, PUMA remains focused on growth with an adjusted EBIT forecast between €520 million and €600 million for 2025, amid uncertainties such as recent U.S. tariffs. Strategic investments in retail networks and digital infrastructure are anticipated to continue, with CAPEX projected at €300 million.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SAPARDIS S.A. news