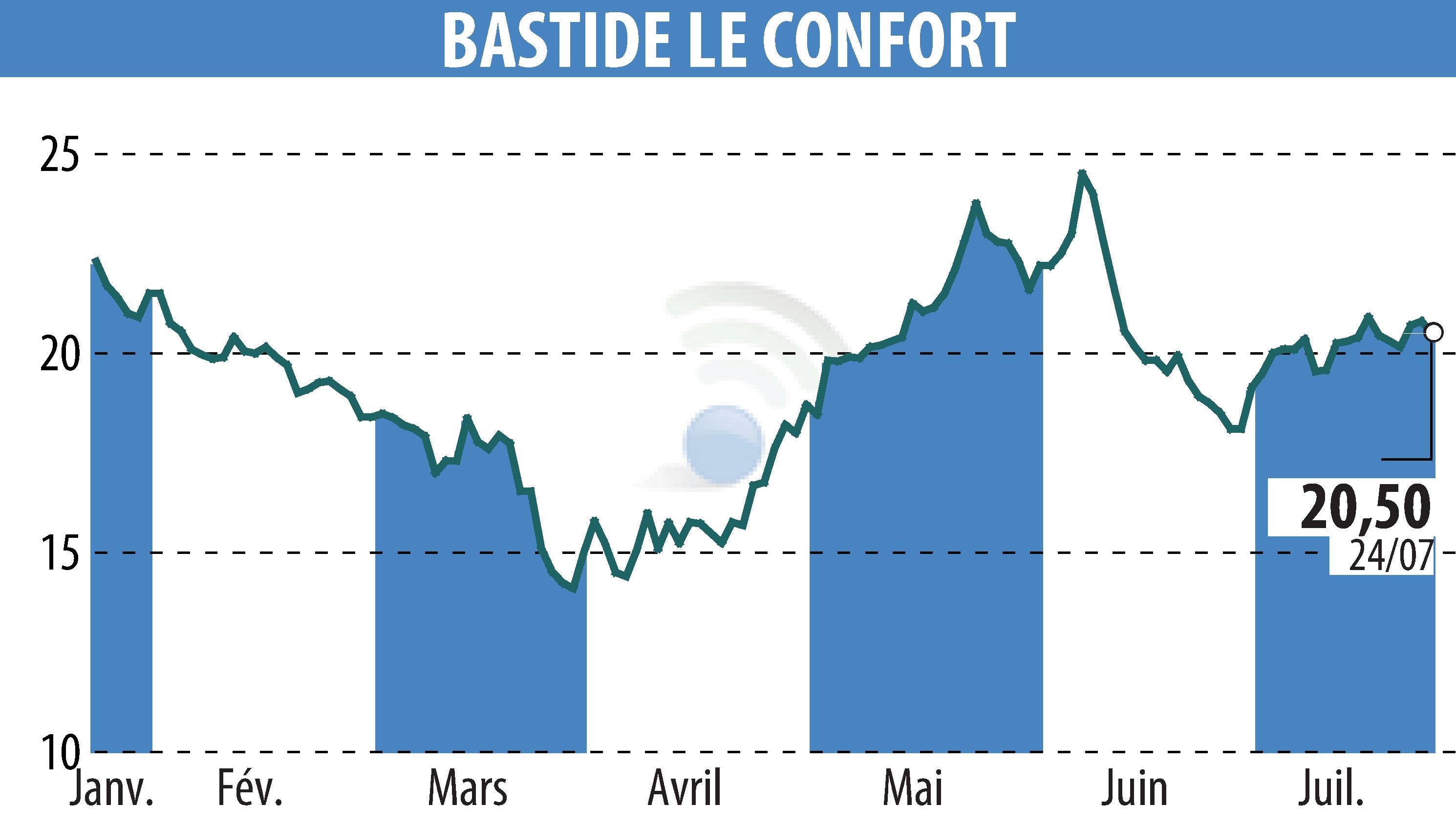

on BASTIDE (EPA:BLC)

The Bastide Group secures its financing with a new syndicated loan

The Bastide Group announces the conclusion of a €375 million financing contract, including a syndicated loan and a revolving loan. This replaces the November 2021 syndicated credit of €270.5 million and bilateral loans of €38.8 million.

The new credit is divided into three tranches: a first of €35 million, amortizable over 5 years, a second of €215 million with maturity in July 2029, and a third of €75 million with maturity in July 2030. A revolving credit of €50 million over 5 years finances investments and growth.

The financing is conditional on a leverage ratio of 4.5 as of December 31, 2024, gradually decreasing to 4.00 as of June 30, 2027. The cost of this debt will be approximately 140 basis points higher than currently.

The Bastide Group mobilizes Natixis, Société Générale and BNP as lead managers. The banking pool includes 10 establishments and three institutional investors. The confidence in Bastide's prospects made it possible to secure this financing without the constraint of selling assets.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all BASTIDE news