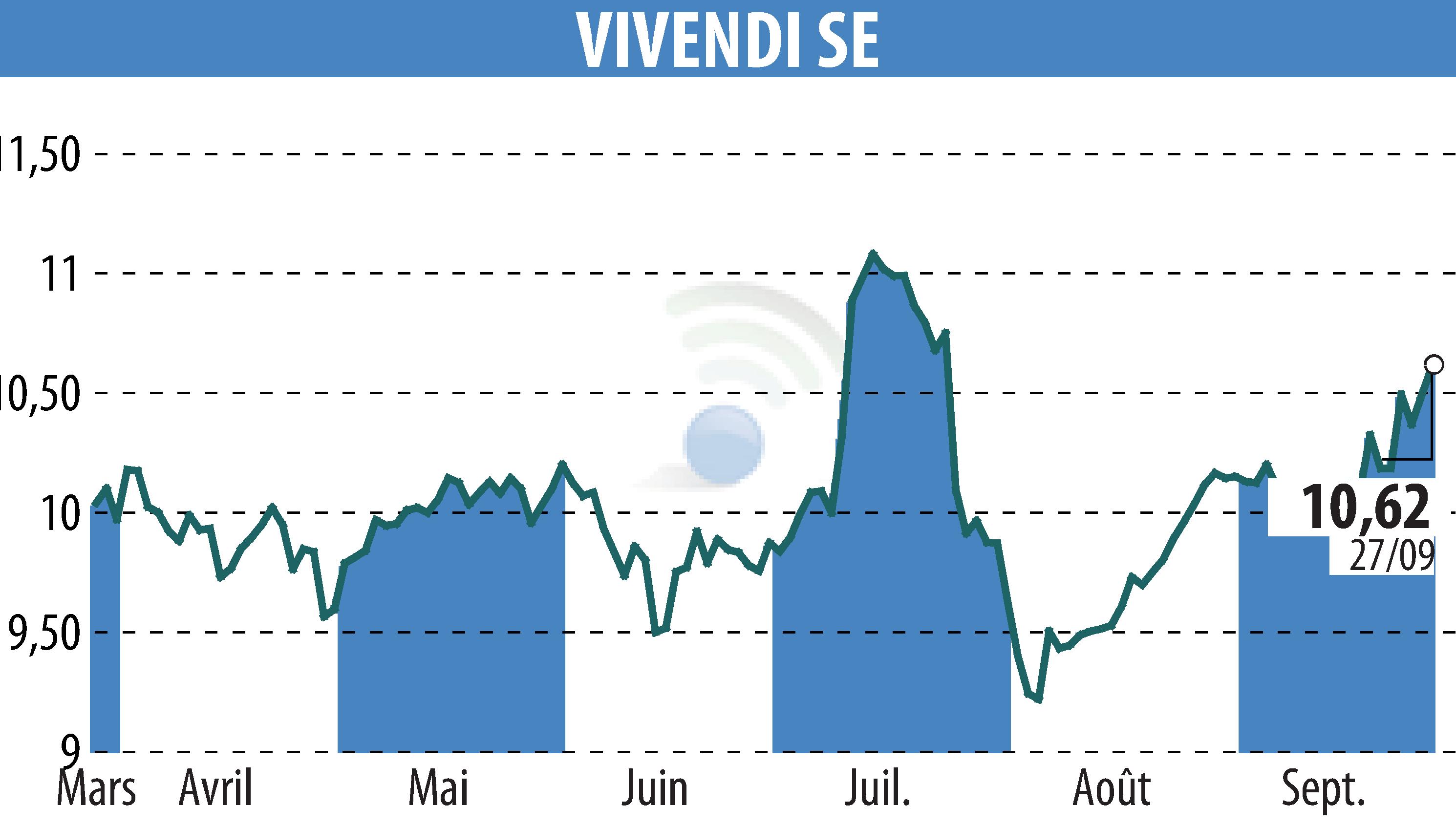

on VIVENDI (EPA:VIV)

Vivendi enters into restructured financing agreements for its bond debt

Paris, September 27, 2024 - Vivendi announced that it has signed financing agreements to ensure the potential repayment of its bond debt. This repayment could be necessary if the Group's spin-off project, currently under review, is approved at an extraordinary general meeting of shareholders.

The bilateral agreements, with a nominal value of 2 billion euros, involve monetary derivatives on a portion of Universal Music Group (UMG) shares and are concluded with five banks. They include pledges of shares held by Vivendi in UMG, Telefonica, Telecom Italia and MediaForEurope.

These financings, maturing in September 2026 and extendable by one year, would allow Vivendi to have the necessary funds to repay its bond debt, following approval of the split by shareholders.

The provision of the funds would lead to the cancellation of the commitments available under Vivendi's syndicated revolving credit agreement and its bilateral contracts. The consultation procedures with employee representative bodies are still ongoing.

If the project progresses, a decision to submit the approval of the split project to shareholders could be taken at the end of October 2024.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all VIVENDI news