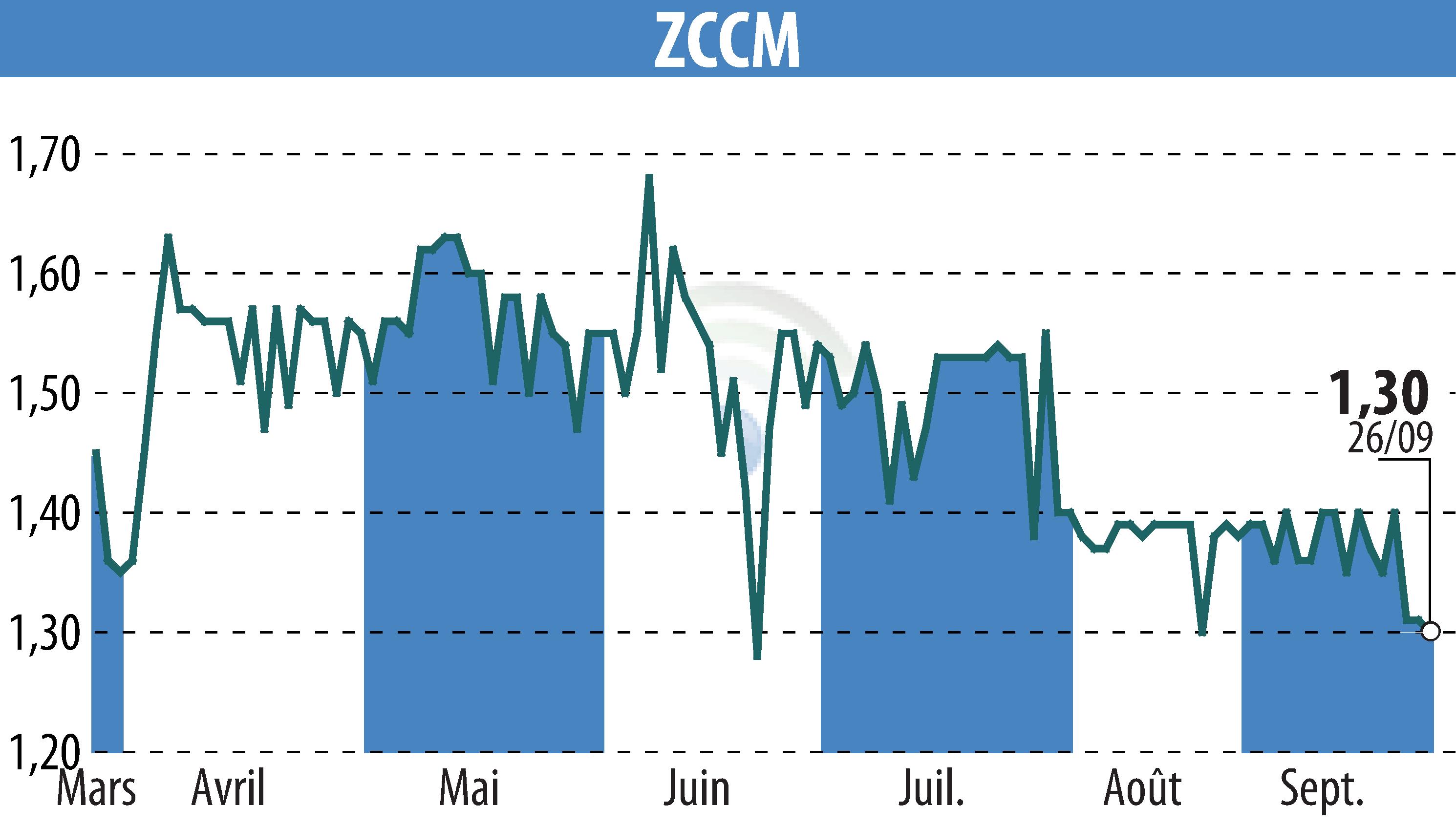

on ZCCM (EPA:MLZAM)

ZCCM-IH Reports Strong Financial Performance in H1 2024

ZCCM Investments Holdings PLC (ZCCM-IH) announced its interim unaudited financial results for the first half of 2024, showcasing significant developments. The Group reported a net profit of ZMW 55.32 billion (USD 2.17 billion), a notable turnaround from a loss of ZMW 2.41 billion (USD 125.84 million) in the same period in 2023. This improvement is primarily attributed to a substantial capital investment by International Resources Holding RSC Ltd through Delta Mining Limited for a 51% stake in Mopani Copper Mines plc. The reclassification of Mopani from a subsidiary to an associate also led to a one-off gain of ZMW 42.3 billion (USD 1.66 billion).

Despite the overall profit, ZCCM-IH reported a company-level loss of ZMW 4.74 billion (USD 185.94 million), compared to a profit of ZMW 551.49 million (USD 28.80 million) in 2023. The Kansanshi Royalty model continued to perform well, generating royalty income of ZMW 564 million (USD 23 million). The energy sector also saw commitments with ZCCM-IH investing in Maamba Energy Limited’s 300MW Phase II Project, estimated to cost USD 400 million.

Key operational achievements include the finalization of KCM's liquidation process and Vedanta's subsequent USD 250 million investment to settle outstanding debts. Kasenseli remedial work resumed, allowing Zambia Gold Company Limited to begin operations in late 2024.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ZCCM news