from Cerrado Gold Inc. (isin : CA1567881018)

Cerrado Gold Files 43–101 Updated Feasibility Study Technical Report for Its Monte Do Carmo Gold Project, Brazil With an Updated After-Tax NPV5% of US$390 Million and IRR of 34%

Feasibility Study Highlights

- After-Tax NPV5% of US$390 million and IRR of 34%

- Average annual gold production of 95,212 ounces per annum over 9-year Life of Mine ("LOM")

- Average AISC of US$687 per ounce over LOM

- Initial Capex of US$181.4 million (including US$15.8 million contingency)

- 2.15x NPV/Initial Capex Ratio

- Annual average free cash flow of $87 million over the LOM, with total cumulative after-tax free cash flow of $588 million over LOM

- Initial Proven and Probable Reserves of 895 koz of Gold (16.8 Mt at 1.66 g/t Au)

- Updated Measured and Indicated Resources of 1,012 koz of Gold (18.4 Mt at 1.72 g/t Au) and Inferred Resources of 66 koz of Gold (1.1 Mt at 1.95 g/t Au)

- Full Technical Report filed on SEDAR+

(All numbers reported in US dollars, unless specifically stated otherwise)

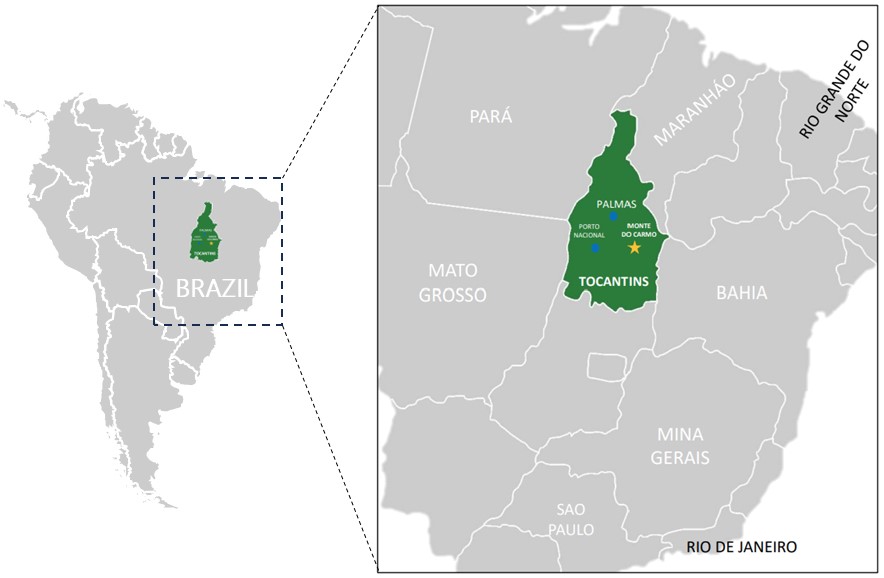

TORONTO, ON / ACCESSWIRE / December 15, 2023 / Cerrado Gold Inc. (TSX.V:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") is pleased to announce that it has filed the technical report of the independent Feasibility Study ("FS") as prepared by DRA Global Limited ("DRA") in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") on its 100% owned Monte do Carmo gold project located in Tocantins State, Brazil. The technical report, shows a positive adjustment to the economic parameters presented in the November 7, 2023 press release outlining results of the Feasibility Study. The full technical report has now been filed on SEDAR+ as of December 15, 2023.

The positive adjustment reflects the results of work undertaken by DRA and GE21 during the completion of the FS to include:

- Recently completed additional metallurgical optimization test work on variability samples have demonstrated improved flotation concentrate leach efficiencies and reduced cyanide consumption rates. Projections indicate that over the life of the mine, an additional 0.4% recovery improvement or 3,7koz of gold is anticipated to be recovered, accompanied by a 2.7% reduction in process operating costs.

- In addition, the receipt of suppliers quote for larger size haulage equipment as well as the optimization of both the open pit and underground mining fleets, resulted in CAPEX savings of $5.2M in direct costs and $2.8M in sustaining costs. This has led to a resulting OPEX reduction of $20 per ounce.

As a result, the After Tax NPV5% increased to $390 million from $369 million and the IRR increased to 34% from 32%. Other financial information pertaining to project capital and operating costs have also been updated in accordance with the changes above.

Mark Brennan, CEO and Chairman, stated: "We are extremely pleased that the ongoing work by DRA has resulted in a modest improvement in what were already robust Feasibility Study results. The Feasibility Study demonstrates that the Monte do Carmo project is poised to be an extremely robust project with low capital and operating costs that will generate cash flows well above its weight as a 100,000 ounce producer of gold while providing an approximate 2:1 ratio of NPV over Capex."

He continued, "With the feasibility study work now completed, we plan to move to the next stage of bringing the project to development. We anticipate we will receive the construction license in Q1 2024 and hope to complete our Export Credit Agency backed financing in Q3 2024."

The FS outlines a robust project, with low capital costs and low operating costs generating significant Free Cash Flow over a 9-year mine life. The FS is focused on the principal Serra Alta deposit and the smaller satellite deposit of Gogo Do Onca and provides a scalable base of production from which to build on future potential exploration success.

Monte do Carmo is expected to commence production at a rate of 1.92 Mtpa from the open pit for total production of 712,989 ounces. In Year 4, simultaneous underground development will be initiated, and is expected to contribute an additional 143,916 ounces over five years of operation.

Two open pit operating scenarios were analyzed for cost estimation purposes. The first scenario involved a traditional owner-operated model, while the second scenario explored a contractor-operated model. Over the 9-year life of the mine, it was found that the owner-operated option produced a higher NPV and other advantages, although resulting in a reduction in IRR. FS selected the owner-operated option for both the Open Pit and Underground Operations.

Ore is processed at the plant using conventional concentration and cyanide leaching of gold bearing concentrates. Tailings will be disposed of using a combination of best in practice dry stack, co-stacking and in-pit filling techniques.

The Company remains on track to receive the construction permit by the end of this year and is progressing Project Financing with an aim to make a fully financed construction decision in Q2 2024.

| Summary of Key Results and Overall Project Economics Production | Units | Value | Updated Value |

| Steady State Throughput | Mtpa | 1.92 | 1.92 |

| Average Annual Production | K oz per annum | 94,797 | 95,212 |

| Life of Mine | Years | 9.0 | 9.0 |

| Life of Mine Au Recovery | % | 95.23 | 95.64 |

| Total Ore Mined - Open Pit | Mt | 14.3 | 14.3 |

| LOM Average Stripping Ratio | x | 7.84 | 7.84 |

| Total Ore Mined - Underground | Mt | 2.5 | 2.5 |

| Total Recovered Gold (Payable) | Ounces | 853,172 | 856,905 |

| Operating Costs | Units | Value | Value |

| Mining | US$/tonne | 17.71 | 17.01 |

| Processing | US$/tonne | 9.32 | 9.11 |

| Water and Tailings Management | US$/tonne | 1.45 | 1.45 |

| G&A | US$/tonne | 2.43 | 2.21 |

| Total Cash Costs | US$/oz | 604.2 | 583.7 |

| AISC | US$/oz | 710.8 | 686.6 |

| Capital Expenditure | Units | Value | Value |

| Initial Capital | US$ M | 170.8 | 165.6 |

| Contingency | US$ M | 15.8 | 15.8 |

| Total Upfront Capital | US$ M | 186.6 | 181.4 |

| Sustaining Capital | US$ M | 68.8 | 66.0 |

| Closure Costs | US$ M | 15 | 15 |

| Total Capital | US$ M | 270.4 | 262.4 |

| Financial Results | Units | Value | Value |

| Pre-Tax NPV | US$ M | 441 | 466 |

| Pre-Tax IRR | % | 35 | 37 |

| Pre-Tax Payback Period | Years | 2.2 | 2.0 |

| After Tax NPV | US$ M | 369 | 390 |

| After Tax IRR | % | 32 | 34 |

| After Tax Payback Period | Years | 2.4 | 2.1 |

| Assumptions | Units | Value | Value |

| Gold Price | US$/oz | 1,750 | 1,750 |

| Discount Rate | % | 5.0 | 5.0 |

Monte do Carmo Project Overview

The Monte do Carmo Gold Project is located in the state of Tocantins, Brazil; 2 km east of the town of Monte do Carmo, 40 km from Porto Nacional and 100 km from Palmas, the capital of Tocantins state. The Serra Alta deposit has been the main focus of exploration and development at the Monte do Carmo Project. Cerrado has conducted preliminary drilling on several analogue satellite deposits however the Company has been mostly focused on infill drilling at Serra Alta to support the Feasibility Study. The Project benefits from convenient access to essential infrastructure including paved roads, energy, 69 kV electrical power line, water supply, and an international airport, and is well supported by the local community.

Geology, Mineralization and Drilling

The regional geology of the Monte do Carmo area is characterized by multiple volcanic-sedimentary sequences with a number of intrusive suites spanning from the Lower to Upper Proterozoic eras, as well as younger Paleozoic sedimentary successions. The Serra Alta deposit itself is hosted by a cupola of the Monte do Carmo Granite (Paleoproterozoic Ipueiras Intrusive Suite) within the Neoproterozoic Araguaia Belt of Tocantins state, located within the broader Trans-Brazilian Lineament.

At the deposit scale, the Monte do Carmo Granite, along with other later felsic and mafic-ultramafic layered intrusions, intrudes felsic volcanic rocks of the Santa Rosa Suite with an overlying (faulted contact) discontinuous quartzite remnant, possibly of the Upper Proterozoic Monte do Carmo Formation. The entire package is in turn unconformably overlain by flat-lying Paleozoic (Meso-Neo Devonian) ferruginous sediments of the Pimenteiras Formation, subject to relatively intense subaerial weathering (i.e., laterite and saprolite development).

The Serra Alta deposit is interpreted as an intrusion-related gold system, with mineralization associated with hydrothermally altered and locally veined granitic rocks. Abundant mineralized shoots are clearly controlled by varying densities of vein and veinlet swarms that are weakly enriched in sulphides (pyrite, galena, sphalerite and chalcopyrite). The deposit currently comprises 8 main zones that span approximately 2 km of strike length (oriented 190-195o) with an overall width of ~600 m, and dip moderately to steeply (55-75o) to the west-northwest with a vertical extent on the order of 200 m. In general, individual mineralized lenses (i.e., shoots) range from approximately 5 m to greater than 30 m in width.

Sheeted vein sets mostly follow the overall deposit trend; however, the presence of multiple mineralized vein orientations indicates a more complex system that evolved over several mineralization and deformation events, as evidenced by the structural history of the area. There are two main northeast-trending (~N30oE) faults that flank the mineralization at Serra Alta, with a series of smaller east-west (± 30o) faults that delimit the deposit into discrete structural blocks; as such, each zone was modelled and estimated individually to respect these constraining features. The lateral extent of the sheeted vein swarms is wider towards the intrusive contact between the main granitic host rocks and overlying felsic volcanics; this intrusive contact acts as a cap throughout much of the deposit.

Modern exploration at the Monte do Carmo Project began in 1985 by Verena Mineração Ltda (VML). A total of 8,629 m of historical drilling in 75 holes has since been completed by several companies, including VML (eventually Monte Sinai Mineração), Paranapanema and Kinross; Rio Tinto also drilled an additional 3,894 m in 53 reverse circulation holes. This work focused on a variety of regional targets in addition to Serra Alta. Recent exploration drilling by Cerrado includes a total of 108,987 m completed in 439 holes up to the database cut-off date of December 31, 2022. The current Mineral Resource Estimate (MRE) includes a total of 12,690 composite sample intervals in 338 holes that intersect the interpreted mineralized domains used for estimation. Historical drilling has been vetted for quality and consistency purposes; only holes that meet a stringent multi-criteria standard were maintained in the database for use in the MRE.

In terms of expansion potential, while the Serra Alta deposit has generally been well-tested, prospective areas of interest to extend mineralization remain both to the east and north, as well as to depth. Additionally, the Monte do Carmo region in general remains highly prospective for exploration potential with multiple high-priority targets already identified within the Cerrado land package.

Data Verification

DRA performed data verification and validation procedures on the drilling database prior to modelling and estimation. DRA reviewed the geological, drilling and analytical data, including the implemented Quality Assurance / Quality Control ("QA/QC") measures, used to support Mineral Resources. Additionally, the QP of Geology and Resources completed a visit to the Project site in order to review overall site geology, drill core, core shack facilities, sample storage and security, as well as to conduct interviews with key site personnel. It is the opinion of the QP that the provided geological database is of sufficient quality for use in the estimation and classification of Mineral Resources, according to CIM guidelines and industry best practices.

Mineral Resource Estimate

The MRE was established using data from boreholes drilled and sampled up to December 31, 2022. The in-pit resource estimate for the Serra Alta deposit includes Measured and Indicated Resources of 15,304 kt @ 1.65 g/t Au for 812 koz, and Inferred Resources of 345 kt @ 1.36 g/t Au for 15 koz; the underground portion includes Measured and Indicated Resources of 3,054 kt @ 2.03 g/t Au for 199 koz, and Inferred Resources of 708 kt @ 2.24 g/t Au for 51 koz. The resource estimate has been prepared using a marginal cut-off grade of 0.26 g/t Au for the in-pit resources; underground resources include low-grade blocks falling within underground reporting shapes to reflect realistic mining logistics. Both the open-pit and underground resources are reported using a gold price of US$1,850. Additional details on mining and processing modifying factors are provided in the footnotes for the table below.

Serra Alta Deposit (Brazil) - Mineral Resources Summary, DRA Global Limited, October 31, 2023 | |||||||

| Category | Tonnage | Average Grade | In-Situ Ounces | ||||

| Open-Pit3,4,5 | |||||||

| Measured | 2,014 | 1.73 | 112 | ||||

| Indicated | 13,290 | 1.64 | 700 | ||||

| Measured + Indicated | 15,304 | 1.65 | 812 | ||||

| Inferred | 345 | 1.36 | 15 | ||||

| Underground6,7,8 | |||||||

| Measured | 42 | 1.66 | 2 | ||||

| Indicated | 3,012 | 2.04 | 197 | ||||

| Measured + Indicated | 3,054 | 2.03 | 199 | ||||

| Inferred | 708 | 2.24 | 51 | ||||

| Total | |||||||

| Measured | 2,056 | 1.73 | 115 | ||||

| Indicated | 16,302 | 1.71 | 897 | ||||

| Measured + Indicated | 18,358 | 1.72 | 1,012 | ||||

| Inferred | 1,053 | 1.95 | 66 | ||||

Notes:

| |||||||

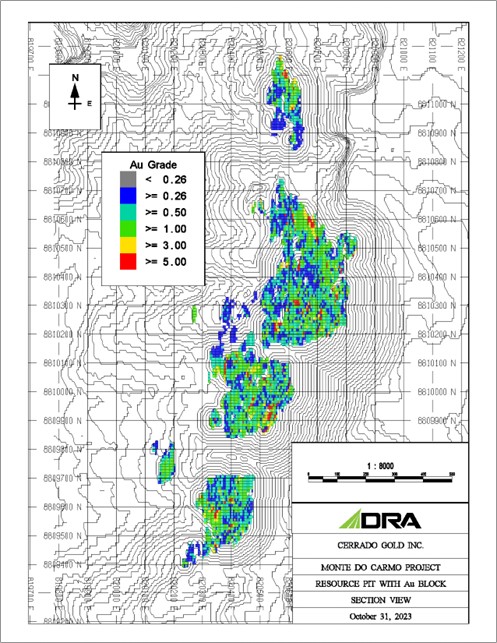

A plan map of the immediate Serra Alta deposit area (shown below) depicts the grade distribution at surface of the estimated Mineral Resources with respect to the optimized pit shell.

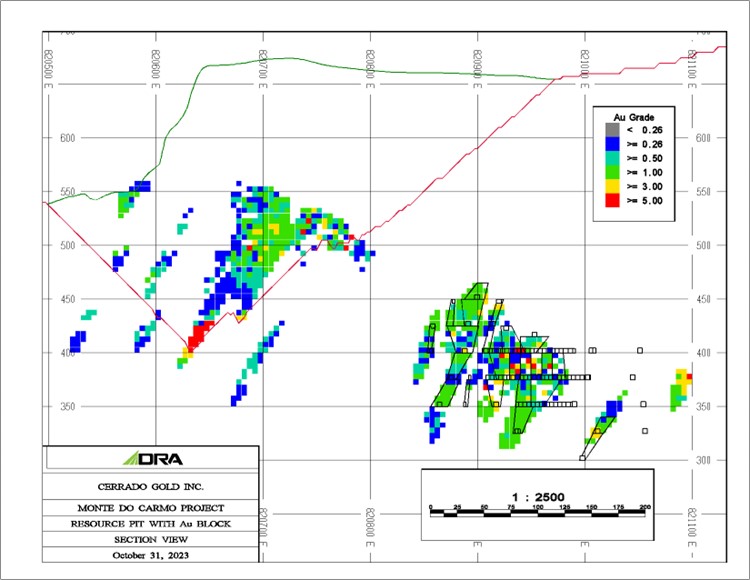

A representative east-west vertical cross-section (looking north) through the core of the deposit (Section 8810420N) is also provided below, highlighting the proximity of estimated blocks outside the pit shell to the east, which represent the underground portion of the reported Mineral Resources.

Mineral Reserve Estimate

The Mineral Reserve Estimate was established using the Mineral Resource Estimate with the effective date of October 31, 2023. The total mineral reserve estimate of the Serra Alta deposit includes Proven Reserves of 2 Mt @ 1.68 g/t Au for 109,000 oz (in-situ) and Probable Reserves of 14.8 Mt @ 1.66 g/t Au for 787,000 oz (in-situ). The reserve estimate has been prepared using a cut-off grade of 0.28 g/t Au for the in-pit reserves, and 0.8 g/t Au for the underground reserves. Both the open-pit and underground reserves are reported using an assumed gold sales price of US$1,700. Additional details on mining and processing factors are provided in the footnotes for the tables below.

The open pit design includes 14,344 kt of Proven and Probable Mineral Reserves at a grade of 1.62 g/t Au. To access these reserves, 112.5 Mt of waste rock must be mined resulting in a stripping ratio of 7.8 to 1.

The underground design includes 2,451 kt of Proven and Probable Mineral Reserves at a grade of 1.90 g/t Au. To access these reserves, 800 m twin ramps will be developed from a mine portal located in the Central Pit. A total of 19,400 m of lateral development in ore and waste will be required during the underground operation. The mining method selected for Monte do Carmo is long hole transverse open stoping with cemented rockfill with minimum stope width of 3 m and maximum height of 20 m. The table below presents the mineral reserves for the underground mine.

| Serra Alta Deposit (Brazil) - Mineral Reserve Estimate, DRA Global Limited. October 31, 2023 | ||||

| Category | Tonnage | Average Grade | In-Situ Ounces | |

| Open Pit 5, 6, 12 | ||||

| Proven | 1,976 | 1.68 | 107 | |

| Probable | 12,368 | 1.61 | 639 | |

| Total Proven and Probable | 14,344 | 1.62 | 746 | |

| Underground 7, 8, 13 | ||||

| Proven | 39 | 1.81 | 2 | |

| Probable | 2,412 | 1.91 | 148 | |

| Total Proven and Probable | 2,451 | 1.90 | 150 | |

Total | ||||

| Proven | 2,015 | 1.68 | 109 | |