from Meridian Mining UK S (isin : GB00BN4LHY20)

Meridian Reports Shallow High-Grade Drill Results and 1km Step Out From Cabaçal

CD-264 returns 12.6m @ 15.5g/t AuEq from 43.3m in Northwest Extension

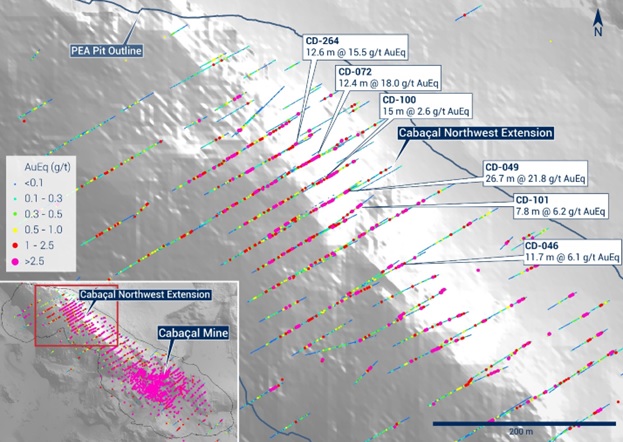

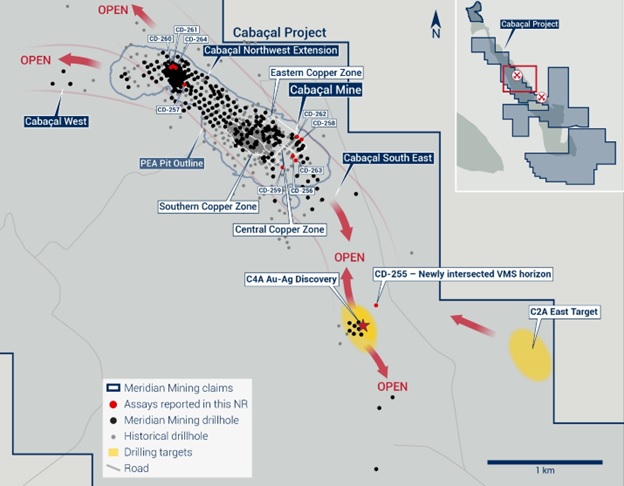

LONDON, UK / ACCESSWIRE / July 11, 2023 / Meridian Mining UK S (TSX:MNO)(OTCQX:MRRDF)(Frankfurt/Tradegate:2MM) ("Meridian" or the "Company") is pleased to provide an update on its programs at Cabaçal, where CD-264 has returned further strong results from the Cabaçal Northwest Extension ("CNWE"). CD-264 has intersected a high-grade zone of 12.6m @ 15.5g/t AuEq (15.3g/t Au, 0.2% Cu & 0.6g/t Ag) from 43.3m, representing a northern extension of similar high-grade results (CD-049, CD-072[1]). This and additional results in the mine area show the potential to better define the projection of higher grade trends across the deposit. In parallel with the resource development program, the Company is advancing with exploration of near-mine extensions, with a copper gossan identified at surface, located 350m southeast of CD-240's copper feeder zone. Drilling has also confirmed the mineralized position of the VMS horizon in a 1km step-out to the southeast of the Cabaçal mine.

Highlights Reported Today

- Cabaçal Northwest Extension returns more high-grade gold intersections;

- CD-264 returns 12.6m @ 15.5g/t AuEq (15.3g/t Au, 0.2% Cu & 0.6g/t Ag) from 43.3m;

- New results consolidate domain of high-grade mineralization extending over 175m;

- 1km step-out along the Cabaçal trend intersects a base metal horizon correlative with the Cabaçal system;

- CD-255 drill hole adds context for further exploration for VMS sulphide mounds;

- Arrival of Geonics down-hole probe to assist in targeting thicker Cu-Zn-Ag-Au zones;

- Preparations advance for mobilization of new Santa Helena drill rig

- Contractor representative due on site this month to prepare for mobilization of regional drill rig, with program to commence at Santa Helena;

- Program targeting verification of historic drilling and exploratory holes into satellite zones surrounding the historic resource ; and

- Cabaçal development studies are advancing in preparation for submission of the Environmental Impact Assessment for the consideration of up to 4.5Mtpa expanded production scenario.

Dr. Adrian McArthur, CEO, comments: "The CD-264 high-grade result of 12.6m @ 15.5g/t AuEq from 43.3m shows the value of infill drilling in achieving better definition of shallow high-grade trends within the Cabaçal deposit. The result continues to build on the importance of the CNWE as a focal point for early production scenarios. We are advancing Cabaçal vigorously on multiple fronts, with drilling, with geotechnical evaluation, and with environmental studies to support expanded production scenarios to be evaluated in a PEA update. Our goal remains to continue moving Cabaçal on its pathway to development, whilst laying the foundation to realize the broader discovery potential of this under-explored belt."

Cabaçal Resource and Extensions

The drilling program at Cabaçal continues to follow recommendations arising from the PEA. The resource definition program aims to achieve better definition of the higher grade trends within the broader mineralized halo. The projection of the high-grade trend at shallowing depths in CD-264 returning 12.6m @ 15.5g/t AuEq from 43.3m is encouraging (Figure 1; Figure 2). Further drilling is being scheduled to test for the projection of the trend within the broader footprint of Cu-Au mineralization, both to the northwest and southeast where the drill spacing is currently more open.

Additional drilling has been conducted in the Eastern Copper Zone ("ECZ"), where it was noted that the high-grade trends in the block model clustered around drill holes in areas of wider spacing, dropping off in-between. The new drill results show that basal concentrations of high-grade mineralization continue in these intervening areas (CD-256 & CD-263; Table 1). The cumulative effect of such results is expected to present a more accurate depiction of the higher grade population across the deposit as the drilling advances for the next resource update. The Company is currently conducting a Mise-a-la-Masse survey to follow up on the geophysical response of stringer sulphide mineralization in the ECZ, with the survey currently targeting extensions to the CD-254 result of 17.7m @ 1.6% CuEq / 2.4g/t AuEq from 50.0m[2].

Exploratory evaluation of the extensions of the Cabaçal system continues. CD-255 was a 1km step-out along the Cabaçal trend (Figure 3). It intersected a base metal horizon interpreted to be correlative with the Cabaçal system (5.3% Zn, 0.1% Cu, 0.2g/t Au & 32.4g/t Ag over 0.3m from 119.9m). The drill hole adds useful context for further planning of exploration for VMS sulphide mounds over time. The Company awaits the arrival of a down-hole probe from Geonics to assist in targeting thicker Cu-Zn-Ag-Au sulphide accumulations, which are less conductive than the copper dominant end member.

Recent prospecting by the geological team has also located some copper gossan at the south-west flank of the resource area (Figure 4). Drilling in this area is sparse, with wide-spaced historical BP holes not sampled systematically from surface. The gossan is located ~350m southeast of CD-240's copper feeder zone, possibly in an up-dip position to the Cabaçal South FLTEM conductivity anomaly[3], where the Company has drilled just one hole. Following recognition of the gossan, trenching will be undertaken to guide further drilling and evaluate possible links to the feeder system.

Santa Helena

Preparations continue at Santa Helena in advance of the arrival of the fourth drill rig. The objective of the drilling program will be to conduct both validation drilling on historical resource holes, and a first phase of exploratory drilling on satellite drill targets marked by geophysical responses for potential discoveries satellite to the main resource.

Project Development

Project development studies are advancing in preparation for submission of the Environmental Impact Assessment (EIA-RIMA), positioning the project for the consideration of an expanded production scenario of up to 4.5Mtpa. Project development studies underway also include a 12-hole geotechnical drilling program. The PEA utilized default assumptions for pit will angles. Based on the PEA pit shell, a series of holes are being drilled to now gather specific data for the next phase of evaluation. If data supports a steepening of pit wall angles in a competent rock mass, results will have a positive impact on the stripping ratio.

Table 1: Drilling results

Hole-ID | Dip | Azi | EOH | Zone | Int | AuEq | CuEq | Cu | Au | Ag | Zn | From |

(m) | (m) | (g/t) | (%) | (%) | (g/t) | (g/t) | (%) | (m) | ||||

CD-264 | -49 | 060 | 98.3 | CNWE | ||||||||

12.6 | 15.5 | 10.4 | 0.2 | 15.3 | 0.6 | 0.0 | 43.3 | |||||

14.7 | 0.6 | 0.4 | 0.2 | 0.3 | 0.6 | 0.0 | 65.5 | |||||

CD-263 | -70 | 048 | 104.1 | ECZ | ||||||||

4.0 | 0.3 | 0.2 | 0.2 | 0.0 | 1.3 | 0.0 | 66.9 | |||||

15.0 | 1.0 | 0.7 | 0.6 | 0.2 | 2.9 | 0.1 | 74.7 | |||||

Including | 4.0 | 2.5 | 1.7 | 1.4 | 0.5 | 7.1 | 0.1 | 85.4 | ||||

CD-262 | -49 | 045 | 49.3 | ECZ | ||||||||

2.6 | 0.5 | 0.3 | 0.3 | 0.1 | 1.1 | 0.0 | 17.0 | |||||

1.3 | 3.3 | 2.2 | 1.8 | 0.6 | 11.3 | 0.1 | 22.8 | |||||

CD-261 | -49 | 059 | 95.3 | CNWE | ||||||||

6.2 | 0.7 | 0.5 | 0.3 | 0.3 | 0.3 | 0.0 | 20.0 | |||||

13.0 | 0.8 | 0.5 | 0.3 | 0.4 | 1.0 | 0.0 | 40.1 | |||||

7.0 | 0.7 | 0.5 | 0.3 | 0.3 | 0.9 | 0.0 | 59.4 | |||||

7.4 | 0.5 | 0.3 | 0.2 | 0.1 | 1.1 | 0.0 | 72.0 | |||||

CD-260 | -49 | 059 | 113.2 | CNWE | ||||||||

1.0 | 1.0 | 0.6 | 0.1 | 0.9 | 0.1 | 0.0 | 13.3 | |||||

1.0 | 0.8 | 0.5 | 0.0 | 0.8 | 0.4 | 0.0 | 18.0 | |||||

20.1 | 0.6 | 0.4 | 0.3 | 0.2 | 1.1 | 0.0 | 34.8 | |||||

6.3 | 0.2 | 0.1 | 0.1 | 0.1 | 1.1 | 0.0 | 61.1 | |||||

10.3 | 0.1 | 0.1 | 0.0 | 0.1 | 2.8 | 1.0 | 85.6 | |||||

CD-259 | -67 | 045 | 36.0 | Cabaçal-Sth | ||||||||

Abandoned | ||||||||||||

CD-258 | -44 | 045 | 49.4 | ECZ / Gabbro | ||||||||

NSI | ||||||||||||

CD-257 | -51 | 058 | 127.2 | CNWE | ||||||||

23.8 | 0.5 | 0.3 | 0.3 | 0.1 | 0.7 | 0.0 | 11.3 | |||||

3.2 | 0.8 | 0.5 | 0.5 | 0.2 | 0.7 | 0.0 | 85.0 | |||||

6.8 | 1.7 | 1.1 | 0.7 | 0.8 | 2.6 | 0.0 | 98.1 | |||||

CD-256 | -90 | 000 | 108.2 | ECZ | ||||||||

4.5 | 0.4 | 0.3 | 0.3 | 0.0 | 0.3 | 0.0 | 16.0 | |||||

28.6 | 0.7 | 0.5 | 0.4 | 0.1 | 2.0 | 0.0 | 66.7 | |||||

Including | 4.9 | 2.3 | 1.5 | 1.2 | 0.5 | 6.2 | 0.2 | 88.5 | ||||

CD-255 | -49 | 046 | 184.1 | C4A-Sth | ||||||||

4.0 | 0.3 | 0.2 | 0.1 | 0.1 | 5.1 | 0.6 | 117.3 | |||||

Including | 0.3 | 0.1 | 0.2 | 32.4 | 5.3 | 119.9 |

About Meridian

Meridian Mining UK S is focused on:

- The development and exploration of the advanced stage Cabaçal VMS goldâcopper project;

- Regional scale exploration of the Cabaçal VMS belt;

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil); and

- Exploring the Espigão polymetallic project in the State of Rondônia, Brazil.

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine within the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within deformed metavolcanic-sedimentary rocks. A later-stage sub-vertical gold overprint event has emplaced high-grade gold mineralization cross-cutting the dipping VMS layers.

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade), including a higher-grade near-surface zone supporting a starter pit.

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and 58.4% IRR from a pre-production capital cost of USD 180 million, leading to capital repayment in 10.6 months (assuming metals price scenario of USD 1,650 per ounces of gold, USD 3.59 per pound of copper, and USD 21.35 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 671 per ounce gold equivalent for the fir