from Rush Rare Metals Corp. (CVE:RSH)

Rush Rare Metals Closes Private Placement and Provides General Update

VANCOUVER, BC / ACCESSWIRE / February 21, 2024 / Rush Rare Metals Corp. ("Rush" or the "Company") (CSE:RSH) is pleased to announce that it has closed its previously announced non-brokered private placement (the "Offering"), raising gross proceeds of $262,115, and to provide a general update regarding its projects in Wyoming and Quebec.

Rush currently has 100% ownership in two projects - a former uranium producer in Wyoming known as Copper Mountain, and a niobium property in Quebec called Boxi showing early promise.

COPPER MOUNTAIN

On October 18, 2023, Rush signed a property option agreement with Myriad Uranium Corp. ("Myriad") pursuant to which Myriad has the option (the "Option") to earn up to a 75% interest in and to Rush's Copper Mountain Project, covering approximately 2,000 acres near Riverton, Wyoming. Before Myriad earns a full 75%, there are requirements for Myriad to make expenditures on the property and to make share payments to Rush, and in addition Rush retains a favourable split on early production (see previous Rush news release dated October 20, 2023 for full details).

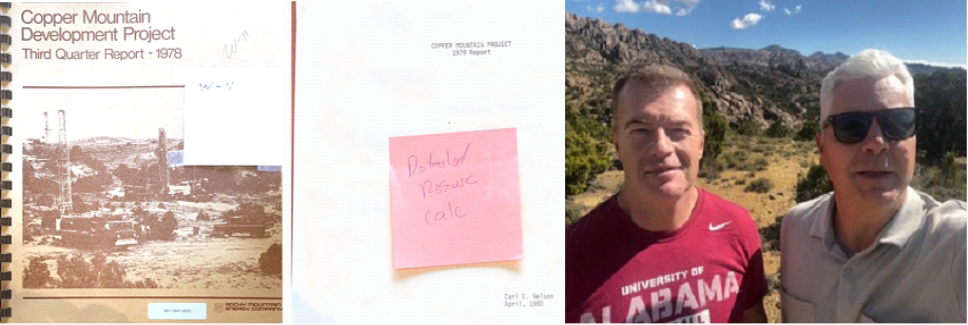

Immediately after executing this agreement, Myriad began a comprehensive review of a cache of recently found historical documents indicating tens of millions in previous exploration work conducted at Copper Mountain, much of it done by Union Pacific prior to 1980. Myriad's review is ongoing, but they released an interim update referenced in a Rush news release dated November 1, 2023. The newly discovered documents include historical resource estimates, mining feasibility studies, geological reports, mining plans, drill logs, and a wealth of other highly useful data. This data has, in turn, provided enormous benefit to Myriad, allowing them to focus efforts on areas previously acknowledged to have the highest grades of uranium and to conduct advanced investigation into new areas that might otherwise have been considered as purely greenfield. It is Rush's understanding that much more is being learned and further updates from Myriad are forthcoming in due course. Images 1, 2, and 3 below show some of the historical data found as well as the Rush and Myriad CEOs at Copper Mountain.

Peter Smith, Rush CEO, commented that "it cannot be overstated what a tremendous head-start this new data gives the project. Subject to verification, we already have strong indications that Copper Mountain has significant amounts of uranium, and perhaps more importantly we know exactly where previous operators were focusing their efforts. Essentially, we get the direct benefit of tens of millions in spending, and we get to pick up where they left off, miles ahead of other projects where maiden drill programs are just underway. We know that over 2,000 drill holes were completed in the area, we have log details for many of those holes, and we also know that Union Pacific had plans to resume mining at Copper Mountain right before the market collapsed in the 1980's. At this point, and with uranium prices trending the right direction, the data suggests we have the blueprints for a potential future uranium producer on our hands. Perhaps the best part for Rush is that we get to sit back and watch the extremely capable team at Myriad analyze all this data and take the project forward, while we get to focus our time and resources on our other project, the Boxi property, in Quebec."

BOXI

Main exploration efforts by Rush are being focused on Boxi, a road-accessible property comprised of over 8,000 hectares a short distance from Mont Laurier. Boxi was formerly explored by Areva S.A. (now Orano), who held the property based on early samples returning very high values for uranium (including one sample returning a value of 11.9% U308). However, Orano dropped the property following the Fukushima incident, and uranium mining was subsequently suspended in Quebec under a temporary moratorium still in place today. Rush originally acquired the property on the strength of niobium values in samples taken by Orano in 2011. Of five samples taken, three returned values of 26.9%, 3.09%, and 2.41% Nb205 respectively. These samples were taken from a mineralized dyke which runs right at surface.

In 2023, Rush engaged in further stripping along further sections of the dyke, taking 17 further samples over a distance of about 2km (the dyke itself may be as long as 14km or longer in total). Of these, all were anomalous for niobium, and the five highest samples returned values of 6.9%, 2.32%, 1.56%, 1.4% and 1.0% Nb205. A visual of a stripped and sampled section of the mineralized dyke is provided in Image 4 below, and full results from the sampling program were provided in Rush's news release dated October 16, 2023.

Niobium is categorized as a critical mineral in Canada and is used to make strong, light weight and corrosion resistant steel, superconductors, and various other highly topical products. There are only three niobium mines of any significance in the world, two of them in Brazil, and the third, the Niobec Mine, just 350 km from Boxi in Quebec. At Niobec, mining occurs at between 90 and 450 meters, and niobium grades are between 0.4 and 0.5% (based on past disclosures made by Niobec's operators).

Interestingly, strong values for uranium also persist at Boxi. Of 22 total known samples from the dyke, 17 returned values for U308 over 200 ppm, 11 returned values of at least 0.1%, and 4 registered at over 1% (with the original sample taken by Orano still being the highest at 11.9%). Again, these samples as well as the above noted niobium samples were all taken right at surface. With recent global emphasis on nuclear power as a strong, low emission alternative to fossil-fuel generated electricity, and with recent uranium exploration/production encouragement by many world governments, the Company feels that it's possible the temporary moratorium in Quebec may soon be lifted.

Peter Smith commented, "of particular interest to us is WA1 Resources, which trades on the ASX. From October 2022 until now, they've gone from a price of $0.14 per share to over $10 per share on the strength of a new niobium discovery in Western Australia. We feel that there's a possibility we can follow their success if we can further expand on some of these early high grades by drilling into our own mineralized system and hopefully showing niobium occurs not only at surface, but for some distance below. It is also noteworthy that there is currently support and encouragement in North America to develop local critical mineral assets. The niobium potential at Boxi is in and of itself a potential company-maker, and if the moratorium on uranium mining in Quebec is lifted, the uranium at Boxi adds yet another highly compelling element to our story. All this in addition to Copper Mountain, with its enormous uranium potential, and being advanced by Myriad."

In 2024, Rush will continue to investigate new sections of the dyke at Boxi, while also attempting to learn more about its overall size and consistency. To this end, it is expected that the Company will engage in some shallow drilling and/or trenching. Moreover, as it is expected that there are many other mineralized systems running throughout the property, further prospecting will be done within the claim area, which is substantial. For any future financings related to Boxi exploration work, Rush would presumably qualify for the federal critical minerals flow-through tax credit, in addition to applicable Quebec flow-through credits.

Qualified Person

Michael Anderson, P. Geo, a "Qualified Person" for the purpose of National Instrument 43-101, has reviewed and approved the scientific or technical information included in this news release respecting the Boxi property. There were no limits on the verification process. Further scientific or technical information in this news release respecting the Boxi property is based on an independent geological report titled "43-101 Technical Report on the BOXI REE-Nb-U Deposit" dated August 6, 2022 and available at Rush's disclosure record on SEDAR+ (www.sedarplus.ca).

PRIVATE PLACEMENT DETAILS

Under the previously referenced Offering, the Company issued an aggregate of 3,744,499 units (each, a "Unit") at a price of $0.07 per Unit. Each Unit consists of one common share of the Company and one share purchase warrant (each, a "Warrant", entitling the holder to purchase one common share at a price of $0.15 per common share for a period of twenty-four (24) months from the date of issuance). Securities issued under the Offering are subject to a four month hold period expiring June 21, 2024, in accordance with applicable Canadian securities laws. The Company intends to use the proceeds from the Offering for general working capital. The Company did not pay any finder's fees in connection with the Offering.

Directors and officers of the Company participated in the Offering, and such participation is considered to be a "related party transaction" as defined under Multilateral Instrument 61-101 ("MI 61-101"). This is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as the fair market value of such participation does not exceed 25% of the market capitalization of the Company, as determined in accordance with MI 61-101.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described in this news release in the United States. Such securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and, accordingly, may not be offered or sold within the United States, or to or for the account or benefit of persons in the United States or "U.S. Persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act, unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements.

About Rush Rare Metals Corp.

Rush Rare Metals Corp. is a mineral exploration company focused on its Boxi Property located in the Province of Québec, Canada. Rush also owns the Copper Mountain Project located in Wyoming, USA, which it has optioned to Myriad Uranium Corp. For further information, please refer to Rush's disclosure record on SEDAR+ (www.sedarplus.ca) or contact Rush by email at psmith@rushraremetals.com or by telephone at 778.999.7030, or refer to Rush's website at www.rushraremetals.com.

Rush Contacts:

Peter Smith

Chief Executive Officer

psmith@rushraremetals.com

###

Mineralization hosted on adjacent or nearby properties is not necessarily indicative of mineralization hosted on the Company's properties. Certain statements in this news release are forward-looking statements, including with respect to future plans, and other matters. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as "may", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, business, economic and capital market conditions, the ability to manage operating expenses, and dependence on key personnel. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, anticipated costs, and the ability to achieve goals. Factors that could cause the actual results to differ materially from those in forward-looking statements include, the continued availability of capital and financing, litigation, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information.

The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The CSE has not reviewed, approved or disapproved the contents of this news release.

SOURCE: Rush Rare Metals Corp.

View the original press release on accesswire.com